Three Rivers Pattern

The Three Rivers candlestick pattern is not widely known but still provides useful reference points; the following article will help you understand it better.

The Three Rivers candlestick pattern is not widely recognized in the crypto market, but it offers valuable insights for traders looking to understand potential market reversals. Despite its relative rarity, learning about this pattern can enhance your trading strategy. Today, we’ll delve deeper into how this pattern works and how it can be applied in trading.

KEY TAKEAWAY

- The Three River Pattern is a bullish reversal signal after a downtrend, featuring a large bearish candle, a small bullish candle, and a large bullish candle.

- The Three Rivers Pattern signals a bullish reversal with a large bearish candle, a small bullish candle, and a large bullish candle, indicating a trend shift from down to up.

- To trade the Three Rivers Candlestick Pattern, identify the pattern after a downtrend, confirm it with volume and indicators, buy after the third candle closes, set profit targets, and monitor the trade to adjust stop-loss and exit if necessary.

WHAT IS THE THREE RIVERS CANDLESTICK PATTERN?

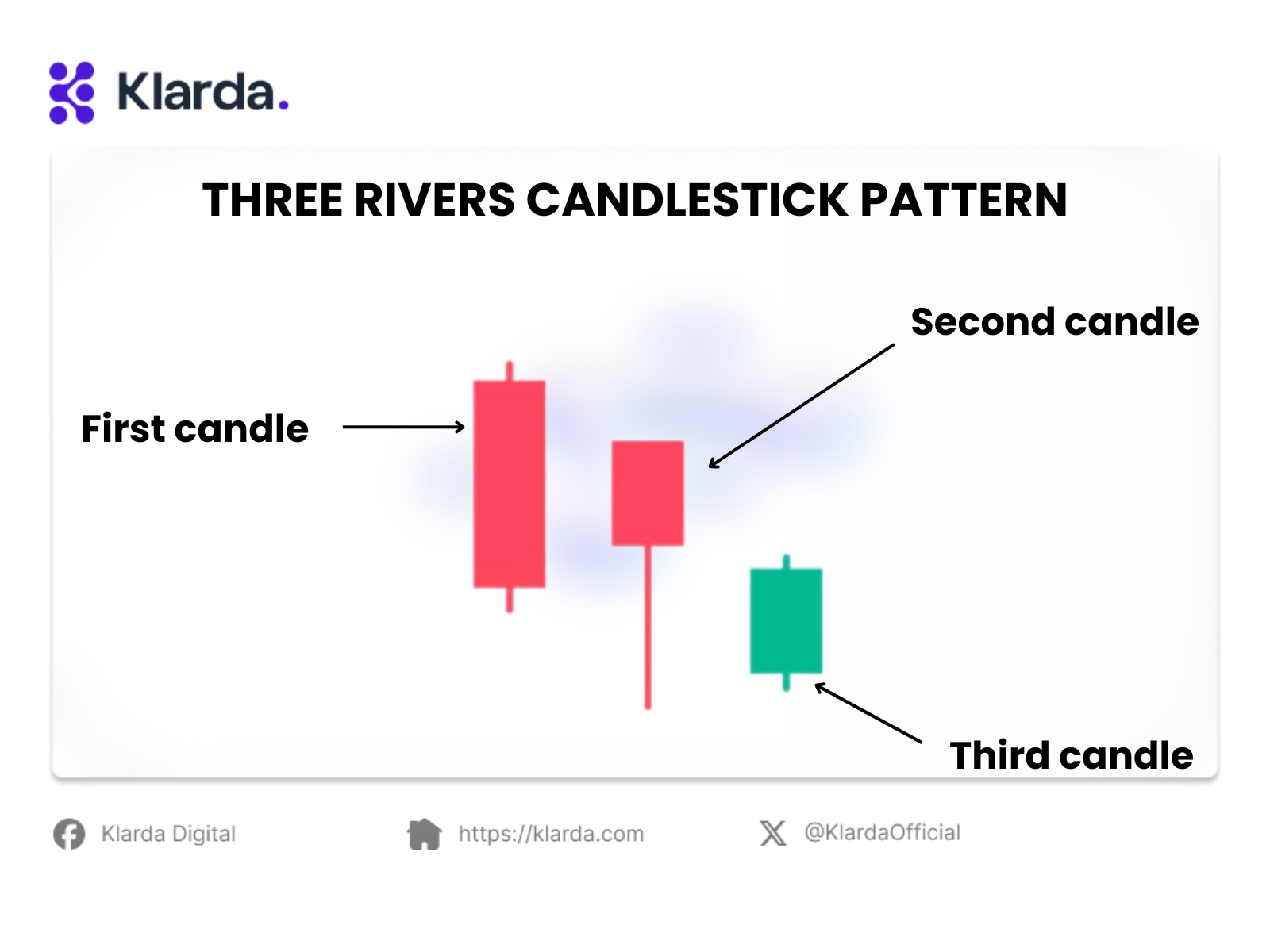

The Three River Candlestick Pattern is a bullish reversal setup occurring after a downtrend, marked by three distinct candlesticks indicating a possible shift from bearish to bullish market direction.The pattern consists of:

- A large bearish candlestick (the first candle) that shows strong selling pressure.

- A small bullish candlestick (the second candle) that indicates a brief pause or slight counter-movement.

- A large bullish candlestick (the third candle) that reflects a significant shift in market sentiment towards buying.

FEATURES OF THREE RIVERS CANDLESTICK PATTERN

The Three Rivers Candlestick Pattern is a bullish reversal pattern consisting of three candles. It begins with a large bearish candle, indicating strong selling pressure. This is followed by a small bullish candle that opens below the previous candle's close and finishes within its body, indicating a period of pause or consolidation. The pattern concludes with a large bullish candle that opens within the body of the second candle and closes above the first candle's close, reflecting a shift toward buying pressure.

This pattern indicates a potential end to the downtrend and the start of a new uptrend. While an increase in volume during the third candle can strengthen the pattern’s signal, additional confirmation through subsequent price action or other indicators is often recommended. The pattern effectively highlights a shift in market sentiment from bearish to bullish.

HOW TO TRADE WITH THREE RIVERS CANDLESTICK PATTERN?

- Identify the Pattern: Identify the pattern after a downtrend by spotting a large bearish candle, a small bullish candle, and a large bullish candle.

- Confirm the Pattern: Verify the pattern's strength by checking for increased volume during the third candlestick and confirming with additional indicators, like RSI or MACD, which should support a bullish reversal.

- Enter a Trade: Place a buy order after the third candlestick closes, indicating the reversal. Set a stop-loss below the low of the first candlestick or recent support to manage potential losses.

- Set Targets: Identify profit targets by looking at recent resistance levels or using tools like Fibonacci retracements. Set targets that reflect a realistic expectation based on historical price movements.

- Monitor and Adjust: Observe price action closely after entering the trade. Adjust the stop-loss to lock in profits if the price moves favorably, and be prepared to exit if the trend shows signs of reversal.

PROS AND CONS THREE RIVERS CANDLESTICK PATTERN

Pros

- Bullish Reversal Signal: It indicates a potential end to a downtrend and the start of an uptrend, which can help traders position for a potential upward move.

- Clear Structure: The pattern is defined by three distinct candlesticks, making it relatively easy to identify once you understand its formation.

- Psychological Insight: It reflects a shift in market sentiment from bearish to bullish, providing valuable information about changing market dynamics.

Cons

- Less Common: It is not as widely recognized or discussed as other candlestick patterns, which may lead to less familiarity and fewer trading resources.

- False Signals: Like any technical pattern, it can produce false signals, especially if not confirmed by other indicators or if the market conditions change rapidly.

- Requires Confirmation: To increase reliability, the pattern often requires confirmation from additional technical indicators or volume, which can complicate trading decisions.

Here’s an overview of the Three Rivers pattern. Although it's not widely used, we hope it enhances your understanding. For accurate and timely trading information, consider the Klarda app, which offers excellent features.

Updated 9 months ago