Hammer Candlestick Patterns

Hammer candlestick patterns are commonly used in technical analysis to predict price trends in the future. The chart has a short candle body and a long shadow.

The Hammer candlestick pattern is a commonly used Japanese candlestick chart widely employed to predict price trends in the future. This chart resembles a hammer with a short candle body and a long shadow below. Investors can interpret this chart as a potential reversal of the price trend.

KEY TAKEAWAYS

- The hammer candlestick pattern is a bullish reversal pattern seen in technical analysis of financial markets.

- It occurs when sellers enter the market during a price decline.

- Types of hammer candlestick patterns include inverted hammer, bearish hammer, double hammer, reverse hammer,...

WHAT IS HAMMER CANDLESTICK PATTERN?

Hammer candlestick patterns occur when a security trades significantly lower than its opening price but experiences a sudden spike, causing the closing price to approach the opening price at the end of the trading session.

This pattern resembles a hammer with a shadow below, typically twice the length of the candle's body. The candle body represents the difference between the opening and closing prices, while the shadow indicates the highest and lowest prices during that period.

What is a hammer candlestick pattern?

TYPES OF HAMMER CANDLESTICK PATTERN

The hammer candlestick pattern comes in various types, including:

Inverted hammer candlestick pattern

The inverted hammer candlestick pattern also known reverse hammer candlestick pattern signals a reversal of an uptrend and takes the form of an inverted hammer. The candle has a small body, a long upper shadow, and almost no lower shadow. The candle opens near the bottom of the preceding downtrend and closes higher as the price increases.

Bearish hammer candlestick pattern

The bearish hammer candlestick indicates that buyers may absorb selling pressure but are unable to push the stock price higher than the opening price. This pattern only signals the potential for a price reversal rather than providing a buy signal.

Bearish hammer candlestick pattern

Double hammer candlestick pattern

The double hammer candlestick pattern consists of two consecutive hammer candles and is considered a strong signal of a bullish reversal. This robust reversal signal indicates that buyers are starting to participate strongly in the market and are willing to drive the price higher.

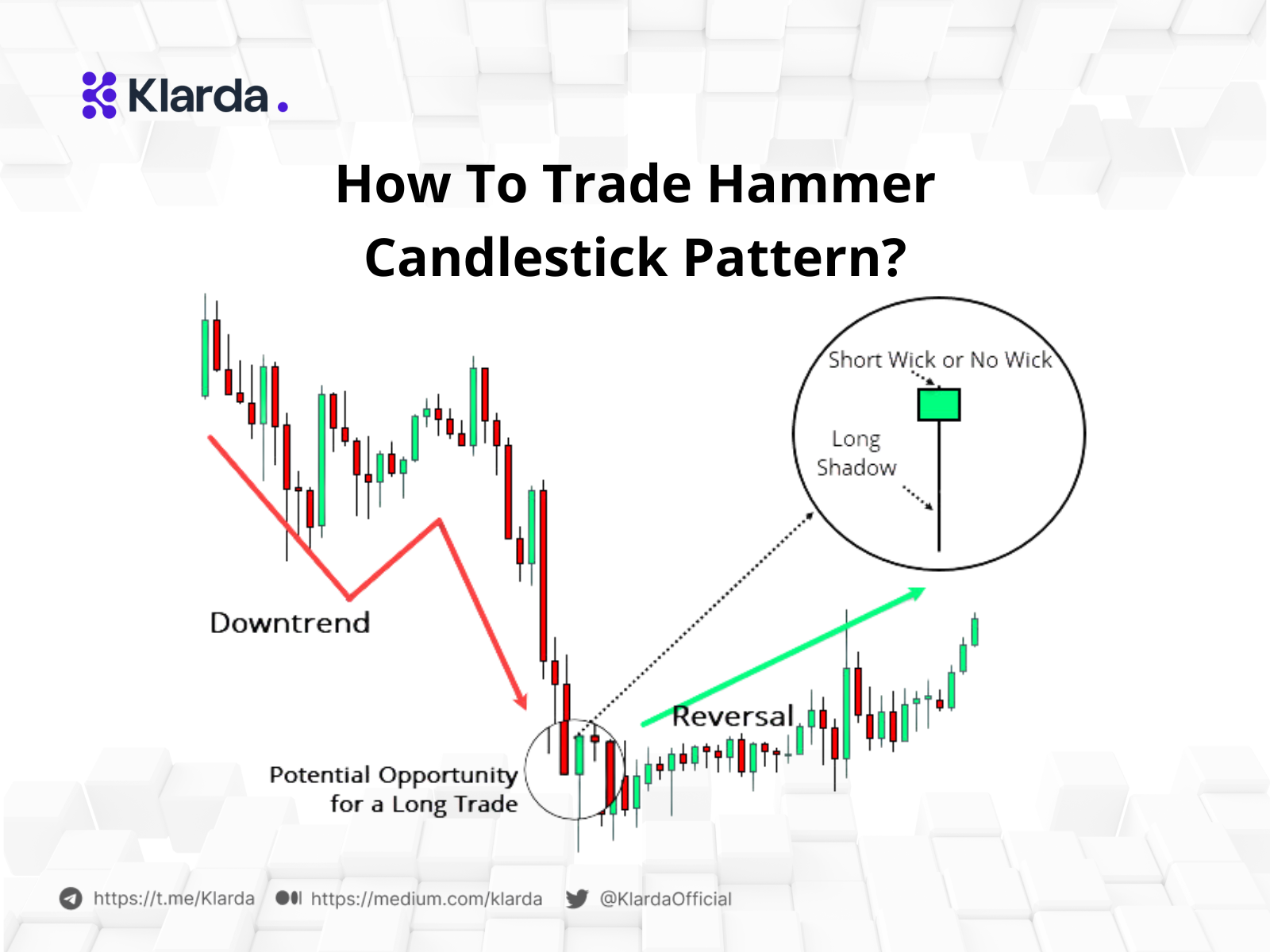

HOW TO TRADE HAMMER CANDLESTICK PATTERN?

Trading with hammer candlesticks is a useful method when analyzing charts and forecasting the price trends of assets in the financial market.

- Step 1: Identify a hammer candlestick with a structure of a small body at the top and a longer lower shadow. The candle appears after a price trend and signifies the potential reversal of the market.

- Step 2: Confirm the signal and wait until the signal concludes. Ensure that the closing price of the hammer candle is above its opening price.

- Step 3: Determine the overall market trend.

- Step 4: Open a buy order when you see a hammer candle in the appropriate context, noting that you should place the buy order after the candle concludes. You can set a stop-loss below the bottom of the hammer candle.

How to trade hammer candlestick pattern?

An important aspect when trading with hammer candlesticks is risk management. It's crucial to set a stop-loss level that aligns with your financial capabilities.

HAMMER CANDLESTICK TRADING STRATEGY

While the hammer candlestick pattern provides potential buying opportunities, its accuracy shines when combined with other technical indicators. Traders can leverage the hammer within three key strategies:

- Top-Bottom: Identify strong downtrends breaking near-term lows. Look for a bullish hammer forming after an indecision candle, indicating possible trend reversal. Enter with a buy stop above the hammer's high and a stop loss below its shadow.

- Support-Resistance: Utilize existing support and resistance levels. When price breaks resistance and retraces to support, wait for a hammer confirmation before entering long.

- Intraday with Moving Average: Within a bullish trend, look for rejections from the dynamic 20 EMA as potential buying opportunities. If a hammer forms near the EMA, enter long at the hammer's high with a stop loss below its shadow.

Stop order placed above the peak price of the hammer is the best entry point

IS A HAMMER CANDLESTICK PATTERN BULLISH?

A bullish trading pattern known as the hammer candlestick may suggest that a stock has bottomed out and is ready for a trend reversal. It shows that purchasers eventually outnumbered sellers, who first pushed the price lower by entering the market and increasing the asset's value. Crucially, the subsequent candle must close above the hammer's previous closing price to validate the upward price reversal.

Hammer candlestick patterns are reversal patterns that occur at the end of a downtrend. When trading with hammer candles, it's important to consider additional indicators such as signals of change and market sentiment to optimize profits.

Updated 10 months ago