What Is The Bearish Belt Hold Candlestick Pattern? How to trade with it?

The Bearish Belt Hold is a straightforward and well-known candlestick pattern. For details, see the article below.

A Bearish Belt Hold is a bearish candlestick pattern observed in an uptrend, indicating a potential trend reversal. What does it signify, and how can you trade it? We'll cover these details in this article.

KEY TAKEAWAY

- The Bearish Belt Hold is a bearish reversal pattern in an uptrend, marked by a bullish candle followed by a second candle that gaps up and closes below the first candle's midpoint.

- A bearish candlestick pattern, characterized by a lack of upper shadow, seller control, and continued downward movement, signals a bearish reversal in uptrends or downtrends.

- Sell only after the Bearish Belt Hold forms, execute sell orders if the next candle closes lower or equal, and set a stop-loss above the pattern. Take partial profits on buy orders to secure gains and reduce risk.

- The bearish Belt Hold pattern offers potential reversal signals and strategic adjustment opportunities but may be unreliable on its own and can produce false signals, so it should be confirmed with additional analysis.

WHAT IS BEARISH BELT HOLD CANDLESTICK PATTERN?

The Bearish Belt Hold candlestick pattern, also known as the Price Belt Hold pattern, is a bearish reversal pattern that typically appears in an uptrend. It's a highly recognizable pattern that frequently occurs near market tops.

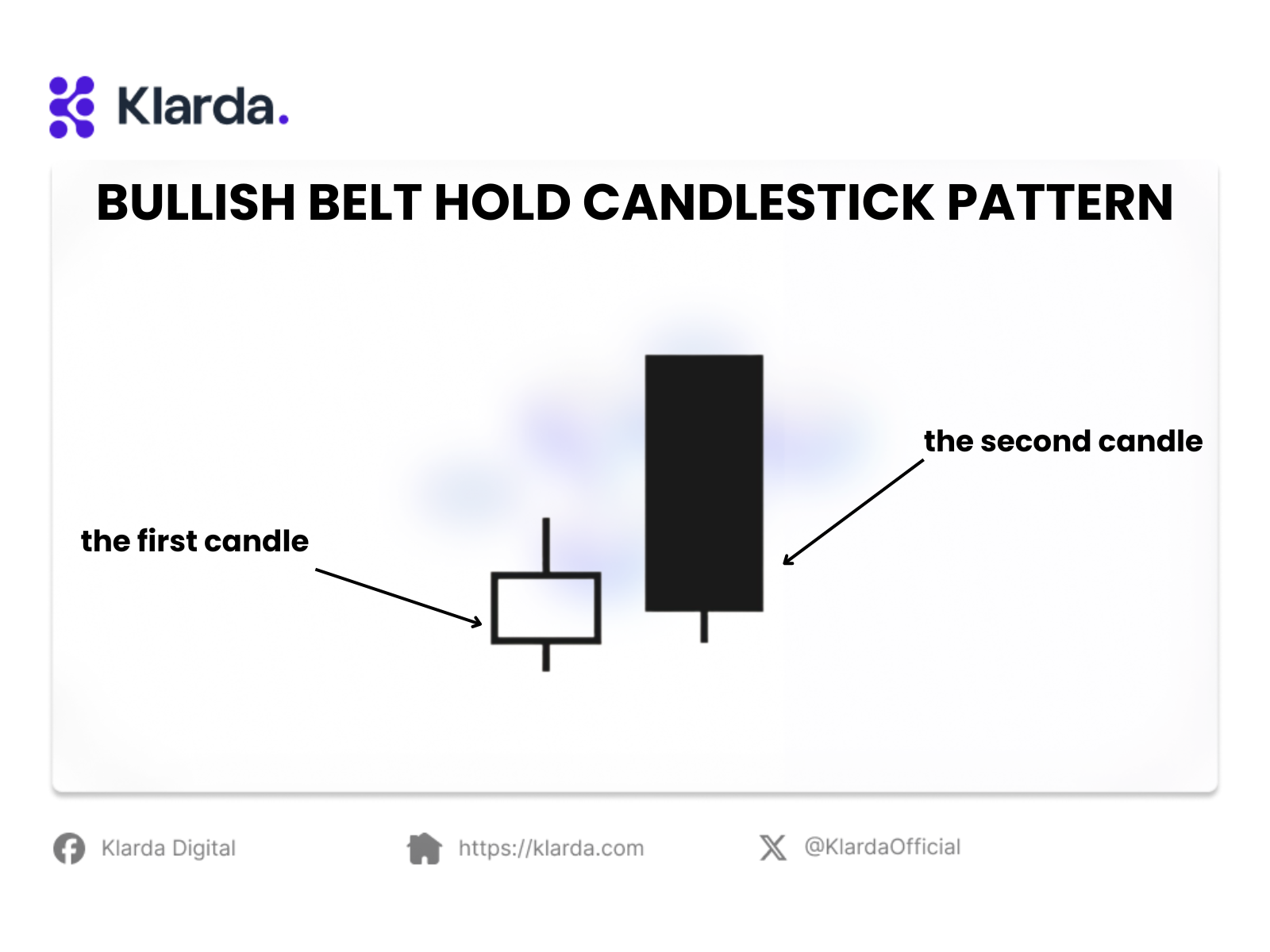

The Bearish Belt Hold is formed by two candles. The first is a bullish candle, while the second opens with an upward gap and closes below the midpoint of the first candle's body. This pattern is considered highly reliable for confirming reversal signals, making it a popular choice among traders.

FEATURES OF BEARISH BELT HOLD CANDLESTICK PATTERN

Here are the main features of a bearish candlestick pattern:

- Reversal Pattern: The bearish candlestick pattern is a bearish reversal formation that can appear during either an uptrend or downtrend. The key for traders is to analyze its development context.

- Absence of Upper Shadow: The bearish pattern is easily identified by the lack of an upper shadow, which is often prominent in bullish Belt Hold Patterns.

- Seller Control: When a bearish Belt Hold develops, it indicates that sellers have controlled the price throughout the trading session, as the stock price did not rise above its opening price.

- Downward Price Movement: The final feature is that the price continues to push lower after opening, which is why the upper shadow is absent. This detail confirms that sellers maintained control throughout the trading session.

HOW TO TRADE WITH BEARISH BELT HOLD CANDLESTICK PATTERN?

With a highly reliable reversal candlestick pattern, investors need an appropriate trading strategy to optimize profits from their trades.

Only initiate sell orders once the Bearish Belt Hold pattern has fully formed. A sell order should be executed when the following candle's price is lower than or equal to the previous candle’s close. The stop-loss should be placed at the top of the pattern, above the opening price of the bearish candle.

For any buy orders previously executed, investors should consider partially taking profits. This helps to secure gains and reduce risks in case the market shifts to a strong downtrend. Don't let a highly profitable trade become a major loss.

PROS AND CONS OF THIS BEARISH BELT HOLD CANDLESTICK PATTERN

The bearish Belt Hold pattern has several advantages and disadvantages

Pros

- Reversal Signal: The bearish Belt Hold pattern can indicate a potential shift in market sentiment from bullish to bearish. This pattern suggests that selling pressure may be increasing, offering traders a chance to anticipate and react to a potential downtrend.

- Strategic Adjustment: For traders, the appearance of a bearish Belt Hold pattern provides an opportunity to adjust their positions. This could involve closing long positions or implementing hedging strategies to mitigate potential losses and protect gains.

Cons

- Reliability Issues: The bearish Belt Hold pattern is not considered highly reliable on its own. It should be confirmed with additional analysis or other technical indicators to improve its predictive accuracy and avoid making trading decisions based solely on this pattern.

- Potential for False Signals: The Bearish Belt Hold pattern can occasionally produce misleading signals, especially in highly volatile or erratic market conditions. Traders who rely solely on this pattern might experience significant losses if the market doesn’t align with the expected bearish trend. Therefore, it's crucial to use this pattern alongside other analytical tools to thoroughly confirm its accuracy and reliability.

In summary, while the Bearish Belt Hold candlestick pattern is popular, it can be challenging for investors to interpret and identify. However, with the Klarda app, you can access timely tools and support to easily address your concerns.

Updated 10 months ago