Doji Candlestick Pattern

Learn about the Doji candlestick pattern: its significance, types, pros, cons, and how to use it for potential trend reversals.

Doji candlestick patterns, characterized by equal opening and closing prices, often signal market indecision or potential trend reversals. Understanding this patterns can guide your trading decisions, highlighting possible trend changes or confirming ongoing trends.

Let's explore our blog to delve deeper into Doji patterns and refine your trading skills.

KEY TAKEAWAYS

- Doji candlesticks are used in technical analysis to help identify price patterns in securities.

- A Doji occurs when a security's opening and closing prices are almost identical, creating a candlestick with a small body on a chart.

- The term "doji" is derived from a Japanese word meaning "the same thing." This type of candlestick is considered neutral, offering limited information on its own.

- Due to their infrequency, Doji formations are not always reliable for detecting price reversals.

- There are three main types of Doji formations: gravestone, long-legged, and dragonfly.

WHAT IS THE DOJI CANDLESTICK PATTERN?

A doji (dōji) refers to a trading session where the opening and closing prices of a security are nearly identical, resulting in a candlestick shape on a chart. Technical analysts use this shape to infer potential price movements. Doji candlesticks can appear as a cross, an inverted cross, or a plus sign.

Although doji formations are relatively rare, they often signal a potential trend reversal when they appear in clusters. They can also indicate market indecision regarding future price movements. Generally, candlestick charts provide insights into market trends, sentiment, momentum, and volatility, with the patterns they form offering signals about market behavior and reactions.

TYPES OF DOJI CANDLESTICK PATTERNS

Here’s a concise overview of the six main types of Doji candlestick patterns:

Gravestone Doji: This pattern features a long upper shadow with the open, close, and low prices clustered near the bottom. It signifies bearish dominance and often appears at the end of an uptrend, indicating a potential trend reversal.

Gravestone Doji Candlestick pattern

Dragonfly Doji: Characterized by a long lower shadow with the open, close, and high prices near the top, this pattern suggests bullish dominance. It commonly appears at the end of a downtrend and can signal a potential trend reversal.

Dragonfly Doji Candlestick pattern

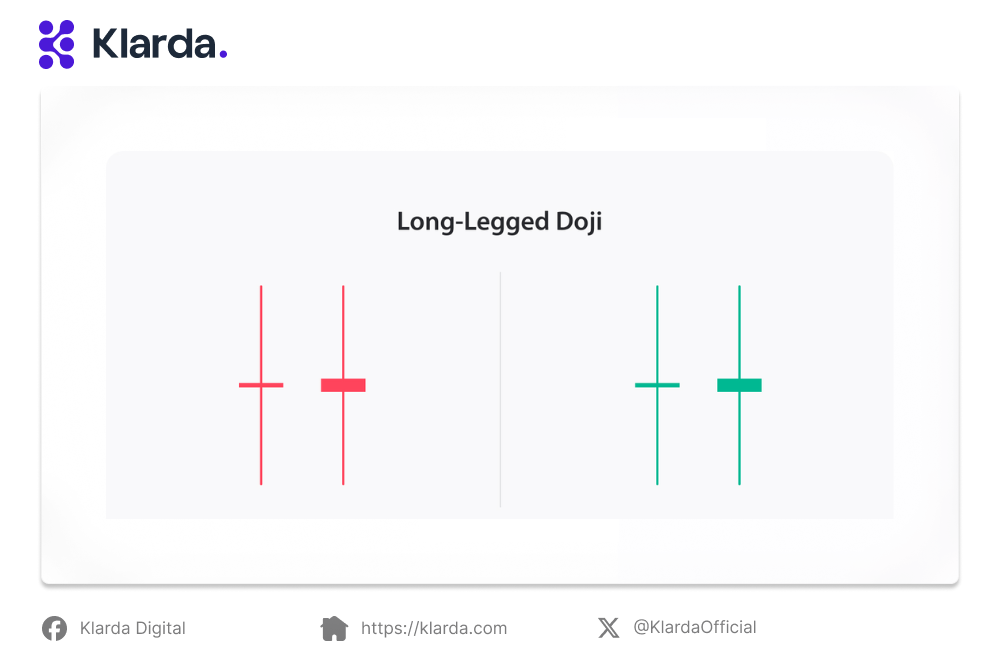

Long-Legged Doji: This pattern has long upper and lower shadows with the open and close prices close to each other, representing market indecision. It indicates uncertainty and may suggest a trend reversal or consolidation.

Long-Legged Doji Candlestick pattern

Standard Doji: Resembling a plus sign or cross, this pattern features open and close prices at the same level with varying shadow lengths. It is interpreted based on preceding and following patterns and signals potential trend changes.

Standard Doji Candlestick pattern

4-Price Doji: All four prices (open, high, low, close) are the same, resulting in a horizontal line. It indicates indecision or a market lull and requires confirmation from subsequent patterns.

4-Price Doji Candlestick pattern

Neutral Doji: With open and close prices the same and equal-length shadows, this pattern reflects a market pause or indecision. Its impact on trends is context-dependent, appearing in both uptrends and downtrends.

Neutral Doji Candlestick pattern

The Dragonfly Doji is considered the most significant, often signaling a bullish trend reversal when it follows a downtrend, particularly if confirmed by other technical indicators.

USING THE DOJI CANDLESTICK PATTERN IN TRADING

The Doji candlestick pattern, as discussed earlier, is a powerful tool for identifying potential reversals or periods of indecision in the market. Here's a more detailed guide on how to use it effectively:

- Identify the Doji:

- Visual Recognition: Look for a candlestick with a very small or no body, and roughly equal upper and lower shadows.

- Confirmation: Double-check the open, close, high, and low prices to ensure they align with the Doji's characteristics.

- Consider the Context:

- Trend Direction: Determine the prevailing trend (uptrend, downtrend, or sideways).

- Support and Resistance: Analyze if the Doji appears near key support or resistance levels.

- Volume: Observe the trading volume accompanying the Doji. High volume can strengthen the signal, while low volume might indicate indecision.

- Evaluate the Type of Doji:

- Regular Doji: Indicates general indecision.

- Gravestone Doji: Suggests potential selling pressure, especially if it appears at a high point.

- Dragonfly Doji: Indicates potential buying pressure, especially if it appears at a low point.

- Shooting Star Doji: Suggests a potential reversal from an uptrend.

- Hammer Doji: Suggests a potential reversal from a downtrend.

- Look for Confirmation:

- Follow-up Candlesticks: Observe the subsequent candlesticks for confirmation. A strong move in the opposite direction of the Doji can signal a reversal.

- Technical Indicators: Combine the Doji with other technical indicators (e.g., moving averages, RSI) for added confirmation.

- Manage Risk:

- Stop-Loss: Set a stop-loss order below the low of the Doji if you're expecting a downtrend reversal, or above the high if expecting an uptrend reversal.

- Take-Profit: Determine a reasonable profit target based on your risk tolerance and market analysis.

PROS AND CONS OF THE DOJI CANDLESTICK PATTERNPros:- Indecision Indicator: Signals market uncertainty, often leading to potential trend reversals.

- Reversal Signals: When used with other indicators, can suggest strong reversal points.

- Ease of Use: Simple to identify, making it accessible for all traders.

- Versatility: Applicable in various market conditions, including uptrends, downtrends, and sideways markets.

Cons:

- False Signals: Can sometimes provide misleading information, so it's best used with other tools.

- Requires Confirmation: A single Doji isn’t always enough to confirm a reversal; additional signals may be needed.

- Timeframe Sensitivity: Its significance can vary by time frame, daily charts generally provide more reliable signals than shorter ones.

- Market Context: Effectiveness can be affected by market volatility and overall sentiment.

In conclusion, the Doji candlestick pattern is a useful tool for spotting potential trend reversals and periods of market indecision. However, it should be used alongside other technical analysis methods and within the broader market context for more accurate trading decisions.CONCLUSION - For beginners, understanding these patterns can be challenging, which is why we recommend the Klarda app. This app provides an easy way to track market movements from your phone or web, making it simpler to stay informed and make strategic trading decisions.

Updated 10 months ago