Simple Moving Average - SMA

The simple moving average line is a commonly used indicator in technical analysis. But what is SMA? The next article will offer additional information.

The simple moving average line is an indicator that helps investors determine trends, resistance, or support in volatile markets like Crypto. So, what exactly is the simple moving average line, and how do you calculate the simple moving average? Let's explore them together through the following article.

KEY TAKEAWAYS

- The simple moving average indicator is one of the popular technical analysis tools in the financial markets, especially in Crypto.

- Calculation of the SMA: We take the sum of the closing prices of the asset over a specific number of trading sessions and divide it by that number of sessions.

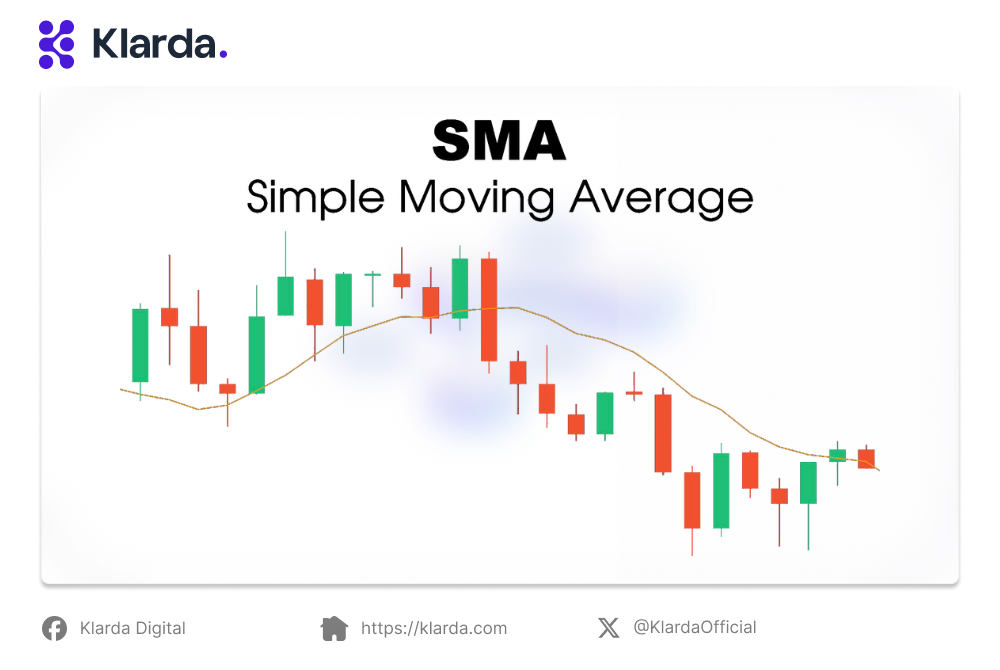

- The SMA simple moving average helps smooth out short-term fluctuations and focuses on the overall market trend. When we use the SMA on a price chart, it creates a seamless curve based on daily trading, representing the average price over a specific period.

- The simple moving average crossover strategy is a straightforward moving average strategy that provides traders with signals to trade when short-term and medium-term moving averages intersect with the long-term moving average.

- This simple moving average trading strategy utilizes three moving averages: a fast one, a medium one, and a slow one.

WHAT IS SIMPLE MOVING AVERAGE?

The Simple Moving Average (SMA) is one of the popular technical analysis tools in the financial markets, especially in Crypto. The SMA is used to determine the price trend of an asset or market over a specific period of time.

The Simple Moving Average (SMA) is a widely used tool in technical analysis.

HOW TO CALCULATE SIMPLE MOVING AVERAGE?

To calculate the Simple Moving Average (SMA), we take the sum of the closing prices of the asset over a specific number of trading sessions and divide it by that number of sessions.

WHAT DID SMA TELL US?

The SMA helps smooth out short-term fluctuations and focuses on the overall market trend. When we use the SMA on a price chart, it creates a seamless curve based on daily trading, representing the average price over a specific period. Therefore, the main functions of the SMA are as follows:

- Trend Identification: The SMA can help determine the general trend of the market. If the SMA is rising, the overall trend is upward; if it is descending, the overall trend is downward. This helps traders identify the long-term trend of the market.

- Crossover Points: One of the common applications of the SMA is to use crossover points between the SMA and the market price to determine entry and exit points in the market.

The SMA helps smooth out short-term fluctuations and focuses on the overall market trend.

SIMPLE MOVING AVERAGE CROSSOVER STRATEGY

This is a simple moving average strategy that provides traders with signals to trade when short-term and medium-term moving averages intersect with the long-term moving average.

Rules of the moving average strategy:

- When the short-term moving average crosses above the long-term moving average → Buy

- When the short-term moving average crosses below the long-term moving average → Sell

- This trading strategy always presents opportunities for traders in the market, whether it's for buying or selling positions.

Note: The signal to close a position is when the red dotted line crosses below the blue line. At this point, the trader would opt for a sell trade in the market.

SIMPLE MOVING AVERAGE TRADING STRATEGY

This moving average strategy uses three moving averages (MA): a fast, a medium, and a slow one. For example of simple moving average, trading signals occur when the fastest moving average crosses above the medium average, similar to the dual strategy. In this approach, the slowest moving average acts as a trend filter. A trader should only take a position if both faster MAs are on the correct side relative to the filter:

- Both MAs moving above the filter → Buy

- Both MAs moving below the filter → Sell

- Traders need to pay attention to two points when observing the red MA crossing the green MA on the chart:

- The first point is the upward crossover, indicating a buy signal. However, since both signal lines are below the filter → no trading.

- The second point is the downward crossover, signaling a sell. Both lines are below the blue line (filter) → open a sell position.

DIFFERENCE BETWEEN SIMPLE MOVING AVERAGE AND EXPONENTIAL MOVING AVERAGE

SMA and EMA differ in their calculation methods, with EMA reacting faster to price changes and SMA reacting slower. The choice between them depends on the trader's strategy and preferences.

EMAs are favored by shorter-term traders for quick alerts to price movements, while longer-term traders often rely on SMAs for a more relaxed approach. Each trader should experiment with both on a chart to determine which suits their decision-making process.

Generally, when the price is above the MA, the trend is up, and when below, the trend is down. It's essential to choose a calculation period that highlights trends and potential reversals. Testing various MAs can help find the most effective one for different financial instruments.

However, relying solely on SMAs may not be sufficient for investors to make investment decisions. They still need a quick and accurate influx of new information as a basis for their decisions. In that case, Klarda is the perfect choice.

Klarda is a feature-rich platform offering cryptocurrency asset management tools, including Klarda Portfolio for continuous and accurate market updates at Klarda Marketplace.

You can track detailed prices and potential of each coin/token, mark favorites with Klarda Favourite, receive suggestions for best-to-buy and best-to-sell exchanges, and get high-accuracy trading signals.

While we hope the simple moving average information is helpful, please note it's shared for informational purposes, and we don't recommend making investment decisions solely based on this article.

Updated 10 months ago