What Is The Mat-Hold Candlestick Pattern? How to trade with it?

The Mat Hold candlestick pattern is quite rare and infrequently observed. What exactly is it, and why is it so infrequent?

The Mat-Hold candlestick pattern is rare but valuable in the crypto market, offering key insights into price continuations and trend predictions. In the following article, we will delve into the details of this pattern and its implications for trading strategies.

KEY TAKEAWAY

- A Mat Hold pattern signals trend continuation, with bullish patterns having a large bullish candle and a final bullish candle, and bearish patterns having a large bearish candle and a final bearish candle.

- The Mat Hold pattern has five candlesticks: a long bullish candle, a small bearish candle, one to three small-range candles, and a final bullish candle that closes above the first, indicating trend consolidation and continuation.

- To identify a Mat Hold pattern, confirm the fifth candlestick closes higher (bullish) or lower (bearish) than the first, enter a position based on this close, set a stop loss below the pattern’s low, and target profit by adding the pattern's height to the breakout point.

- The Mat Hold pattern signals a bullish trend continuation but has pros like strong signals, clear structure, and versatile use, and cons such as infrequent appearance, potential false signals, and the need for additional confirmation.

WHAT IS MAT-HOLD CANDLESTICK PATTERN?

A Mat Hold pattern is a candlestick formation that signals the continuation of an existing trend.

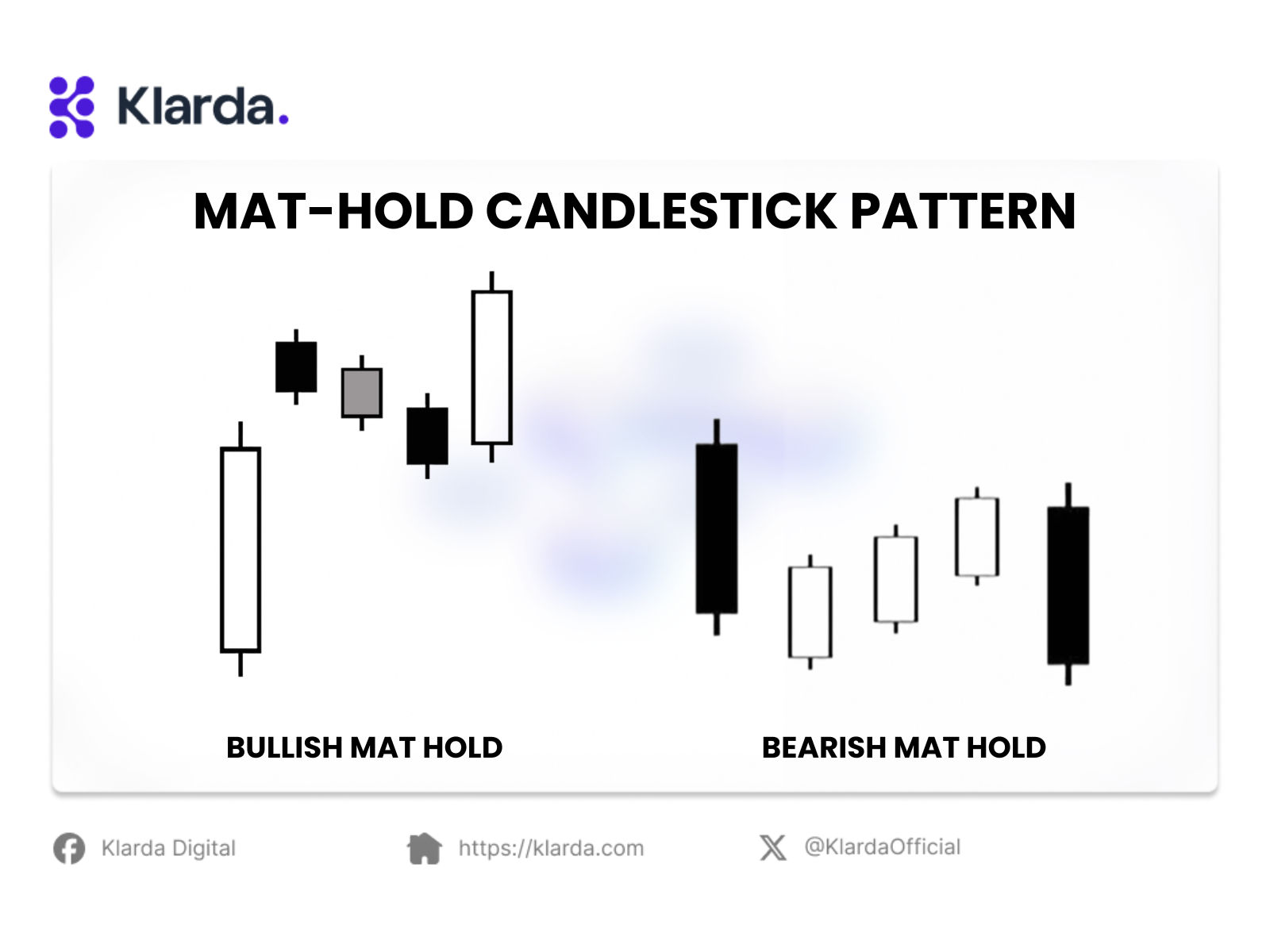

There are both bullish and bearish variations of the Mat Hold pattern.

Bullish Mat Hold

This pattern begins with a large bullish candle, followed by a gap up and three smaller bearish candles that stay above the low of the initial large candle. The pattern concludes with a significant bullish candle that resumes the upward movement. It occurs within an overall uptrend.

Bearish Mat Hold

This pattern starts with a large bearish candle, followed by a gap down and three smaller bullish candles that remain below the high of the first large candle. The pattern ends with a substantial bearish candle that continues the downward movement. It appears within a downtrend.

FEATURES OF MAT-HOLD CANDLESTICK PATTERN

The Mat Hold pattern is composed of five candlesticks:

- A long bullish candlestick.

- A small bearish candlestick.

- One to three additional small candlesticks, either bullish or bearish, each contained within the range of the second candlestick.

- A final bullish candlestick that closes above the close of the first candlestick.

This pattern is characterized by the small bearish candlestick following the initial bullish candlestick, which is then succeeded by small-range candles, indicating consolidation or a minor pullback. The pattern concludes with a bullish candlestick that reaffirms the uptrend.

HOW TO TRADE WITH MAT-HOLD CANDLESTICK PATTERN

When identifying a Mat Hold pattern, follow these practical steps:

- Confirmation: Wait for the fifth candlestick to close higher (bullish) or lower (bearish) than the first.

- Entry Point: Consider entering a long position if the fifth candlestick closes above the high of the first candlestick in a bullish pattern, or a short position if it closes below the low in a bearish pattern.

- Stop Loss: Set a stop loss below the lowest point of the pattern, which could be the low of the second, third, or fourth candlestick, depending on which is lowest.

- Profit Target: Establish a profit target by adding the height of the pattern (the distance from the high of the first candlestick to the low of the pattern) to the breakout point.

Trading Tips and Guidelines

- The Mat Hold pattern is a bullish continuation pattern and is more reliable within an uptrend.

- The bearish second candlestick typically indicates profit-taking after a strong bullish move.

- The third and fourth candlesticks reflect consolidation, which is normal and healthy in an uptrend.

PROS AND CONS OF THIS MAT-HOLD CANDLESTICK PATTERN

The Mat Hold pattern indicates a continuation of a bullish trend and provides valuable insights into market behavior.

However, like all trading patterns, it has its advantages and challenges. Understanding these can help traders effectively integrate the Mat Hold pattern into their strategies.

Pros:

- Strong Bullish Signal: The Mat Hold pattern is a reliable indicator of an ongoing upward trend, suggesting strong positive sentiment and offering opportunities to enter or maintain positions.

- Clear Pattern Structure: Its straightforward formation—starting with a large bullish candle, followed by a consolidation phase, and ending with another bullish rise—makes it easy to identify and act upon.

- Versatile Application: This pattern is useful across various trading environments and markets, including stocks, commodities, and currencies, making it a flexible tool for different trading styles.

Cons:

- Infrequent Appearance: The Mat Hold pattern does not occur as often as other candlestick patterns, which may limit trading opportunities and result in missed trades.

- Potential for False Signals: Like other technical indicators, it can sometimes produce false signals. Misinterpretation or lack of confirmation may lead to premature or incorrect trades.

- Need for Additional Confirmation: Traders often require further confirmation from other indicators or market analysis to validate the pattern. Relying solely on the Mat Hold pattern without considering broader market factors can increase the risk of errors.

In summary, while the Mat-Hold pattern is less common now, it still holds value. Newcomers may find it challenging, but the Klarda app offers tools and support to help.

Updated 10 months ago