Bullish Counterattack Pattern

The Bullish Counterattack candlestick pattern indicates a possible market reversal. Discover more in the article below.

The Bullish Counterattack candlestick pattern is a two-candle reversal pattern with a somewhat surprising psychological effect. This two-candle pattern can appear on daily charts or during rapid price movements, such as when market news is released. But what exactly are they? Let's delve into this in the article below.

KEY TAKEAWAY

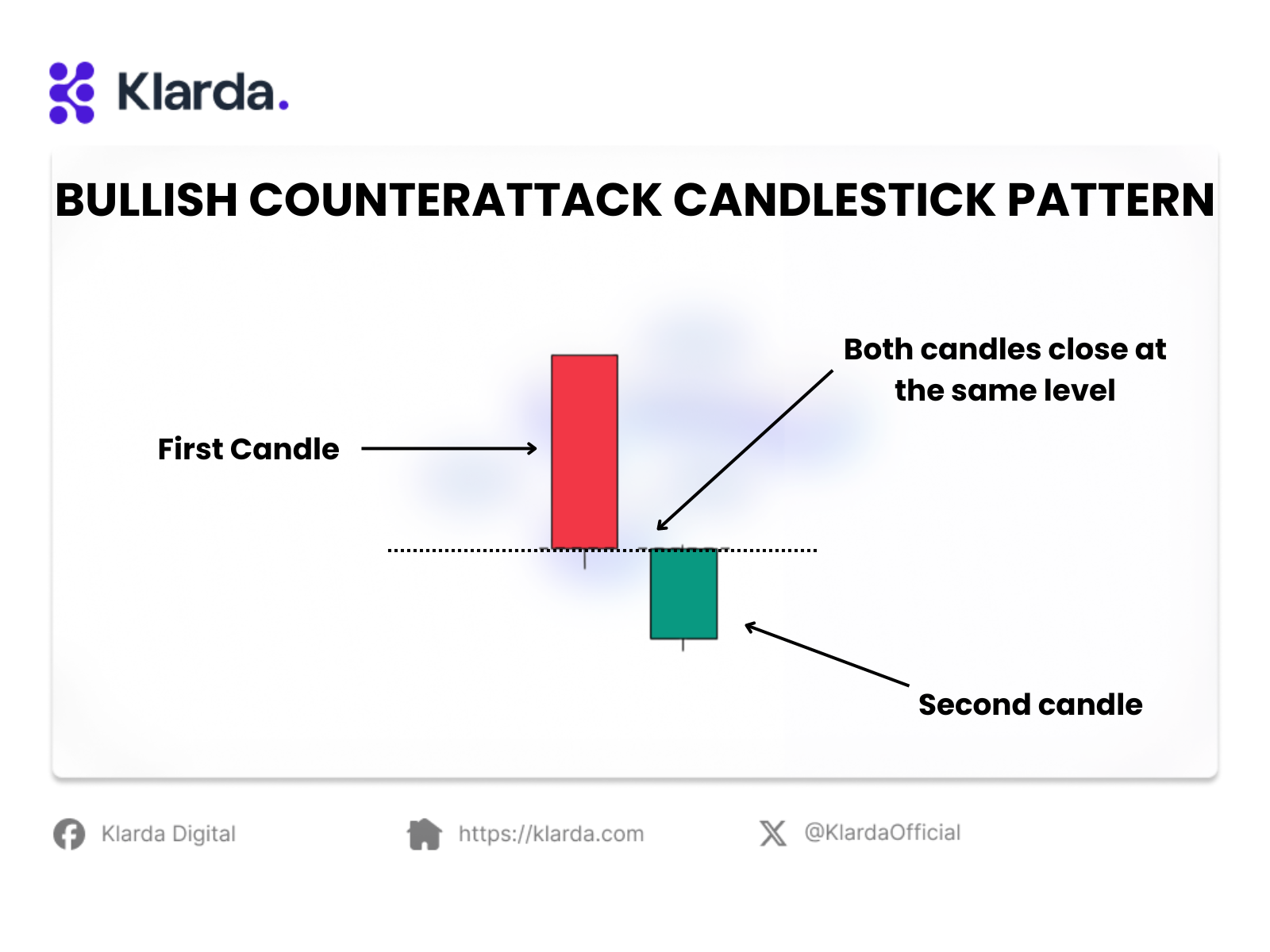

- The Bullish Counterattack is a minor reversal pattern where a bearish candle is followed by a bullish one that closes at the same level.

- The Bullish Counterattack, seen during a downtrend, features a bearish first candle and a bullish second candle that opens lower but closes at the first candle's level, suggesting a potential bullish reversal and marking a key level.

- Trade the Bullish Counterattack Pattern by going long after the next candle closes above its high, setting a stop-loss at the pattern's low, and exiting at resistance or holding through a breakout.

- The Bullish Counterattack pattern clearly signals potential trend reversals, is generally reliable after a downtrend, and offers flexible trade entries, but it can produce false signals, may not always indicate a reversal, and requires experience to use effectively.

WHAT IS THE BULLISH COUNTERATTACK CANDLESTICK PATTERN?

The Bullish Counterattack candlestick pattern is a minor reversal pattern in Japanese candlestick analysis that typically appears after a downtrend. It suggests a possible bottom reversal, though weaker than the Piercing Pattern. The pattern begins with a bearish candle, followed by a second candle that opens much lower but recovers to close at the same level as the first candle.

This second candle is a strong bullish one. Initially, the gap down on the second day gives sellers confidence that the downtrend will continue, but they are caught off guard as the price reverses, fills the gap, and closes at the previous candle's level, leaving sellers with no gains for the day.

FEATURES OF BULLISH COUNTERATTACK CANDLESTICK PATTERN

The Bullish Counterattack candlestick pattern has key characteristics:

- It appears during a downtrend.

- The first candlestick is bearish.

- The second candlestick opens with a gap down and is bullish, closing at the same level as the first candle's close.

This pattern is rare in short time frames on forex charts and is more common on daily charts or during rapid market movements, especially around major news events. Although moderately reliable, its effectiveness increases if the candlesticks have long bodies, particularly the second one.

Typically, the market is in a downtrend, and the first candlestick continues this trend, boosting bearish confidence. However, the gap on the second candle depletes selling pressure, allowing the bulls to push the price higher, closing near the first candle's close. This suggests a potential bullish reversal, usually confirmed by subsequent candles. The Bullish Counterattack Line often marks a key psychological level, potentially signaling a reversal or establishing new support.

HOW TO TRADE WITH BULLISH COUNTERATTACK CANDLESTICK PATTERN?

To trade the Bullish Counterattack Pattern, enter long when the next candle closes above its high, indicating buyer control and a potential reversal, and set a stop-loss at the pattern's low to manage risk.

For your exit strategy, close the position when the price reaches a significant resistance level. If you're looking to extend the trade, watch for a breakout near the resistance level, and if it occurs, continue holding until the price reaches the next resistance level.

PROS AND CONS OF BULLISH COUNTERATTACK CANDLESTICK PATTERN

Pros:

- Clear Signal: The Bullish Counterattack pattern offers a clear indication of a potential trend reversal, making it straightforward to identify and trade.

- Dependable: The pattern is generally reliable after a downtrend, signaling a potential market shift.

- Flexible Trade Entry: It can be used to initiate long positions or exit short positions, providing traders with versatile entry and exit options.

Cons:

- False Signals: Like any trading strategy, the Bullish Counterattack pattern can sometimes produce false signals, which may result in losses.

- Not Always Reliable: The pattern doesn't always indicate a trend reversal, which can lead to missed opportunities.

- Requires Experience: Effective use of the Bullish Counterattack pattern requires a solid understanding of candlestick charting and technical analysis, making it more suitable for experienced traders.

That’s all the information we have on the Bullish Counterattack candlestick pattern. We hope it helps you identify market reversals. For those new to trading, finding accurate and timely information can be tough, so we recommend the Klarda app, known for its excellent features.

Updated 10 months ago