Bullish Flag Pattern

Discover how to trade the bullish flag pattern effectively. Learn key steps to identify, enter, and exit trades for maximum profit.

KEY TAKEAWAYS

- In technical analysis, a flag pattern on a price chart features a sharp countertrend movement (the flag) following a brief trend (the flagpole).

- A bullish flag resembles an upright flag on the chart, with a rectangular pattern representing the flag. A tighter flag pattern is generally considered a stronger signal.

WHAT IS A BULLISH FLAG PATTERN?

Bullish flag patterns appear in stocks with strong uptrends and are effective continuation indicators. The pattern resembles a flag on a pole: the pole is a sharp price increase, and the flag represents a consolidation phase. The flag may be horizontal or slope downward, and the bullish pennant forms a symmetrical triangle during consolidation.

The flag's shape is less important than the underlying market psychology. Despite a significant rally, the stock remains strong as buyers continue purchasing, leading to a breakout and often a substantial upward move. Similar patterns exist in reverse, known as bear flags and pennants, and usually occur during new market rallies.

HOW TO IDENTIFY A BULLISH FLAG PATTERN?

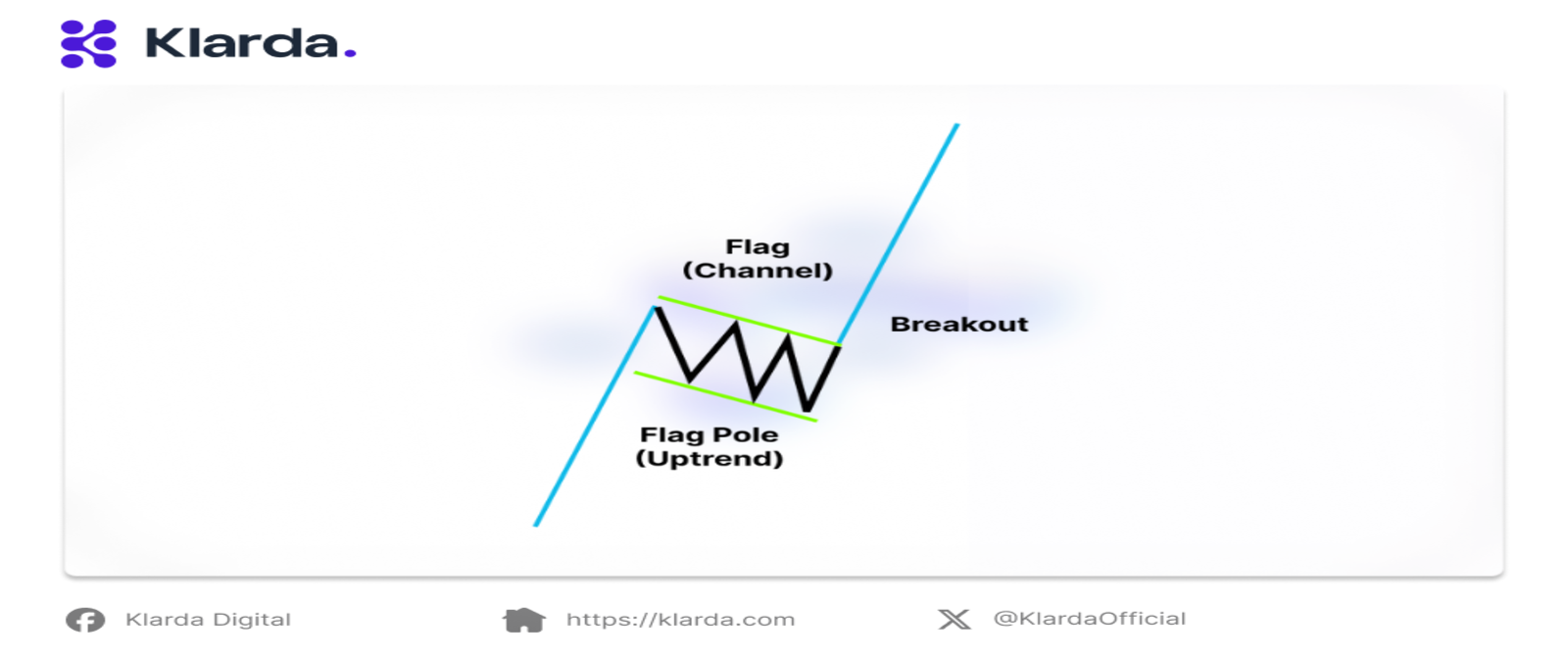

Bullish flag pattern component

To identify a bullish flag pattern, look for the following characteristics:

Upward Trend: A clear upward trend should precede the pattern. This indicates that the market is already in a bullish phase.

Flagpole: A sharp, vertical rise in price forms the flagpole. This represents a strong buying impulse.

Flag: After the flagpole, the price consolidates in a rectangular or pennant shape. This is the flag, which typically lasts for a few days to a few weeks.

Breakout: The pattern is confirmed when the price breaks above the upper resistance level of the flag. This breakout signals a continuation of the uptrend.1

WHEN TO TRADE THE BULLISH FLAG PATTERN

The best time to trade a bullish flag pattern is when the price breaks above the upper resistance level of the flag. However, it's important to consider other factors before entering a trade:

- Volume: A significant increase in volume during the breakout can strengthen the bullish signal.

- Support and Resistance: Identify nearby support and resistance levels to assess the potential profit targets and stop-loss levels.

- Overall Market Sentiment: Consider the broader market context to avoid trading against the prevailing trend.

BULLISH FLAG STRATEGIES

When trading the bullish flag pattern, there are several effective strategies to consider.

Here are some strategies for trading the bullish flag pattern:

- Breakout Buy: Enter a long position immediately after the price breaks above the upper resistance level of the flag.

- Pullback Buy: If the price pulls back slightly after the breakout, consider buying at a lower price.

- Stop-Loss: Place a stop-loss order below the low of the flag to limit your potential losses.

- Profit Target: Set a profit target based on the height of the flagpole. For example, if the flagpole is 10 points, target a profit of 10 points from the breakout point.

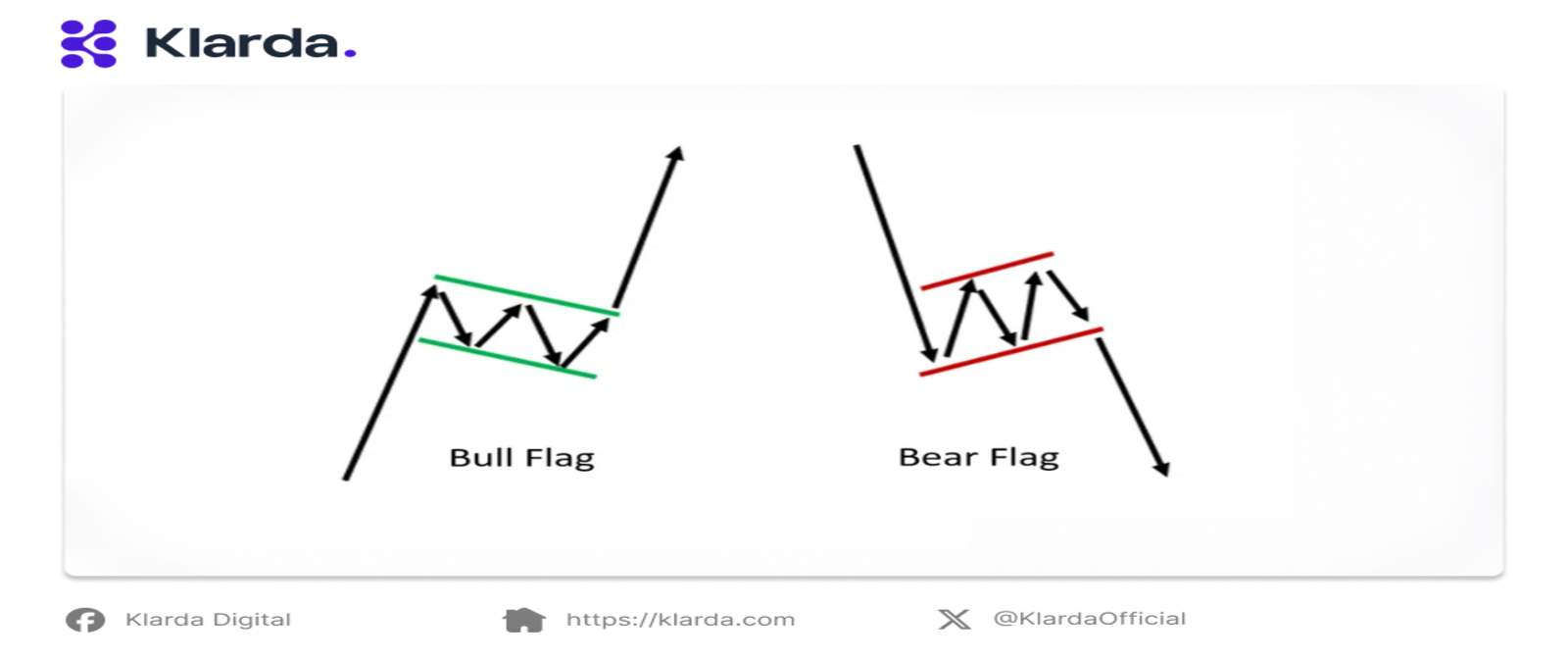

BULLISH FLAG VS. BEARISH FLAG

Bullish Flag vs Bearish Flag

Understanding the difference between bull and bear flags is crucial for traders analyzing market trends. Both patterns signal continuation but in opposite directions.

Bear Flag: Forms in a downtrend, starting with a sharp decline (flagpole) followed by upward or sideways consolidation (flag). Volume drops during consolidation and spikes when the price breaks lower, signaling to enter short positions.

Bull Flag: Occurs in an uptrend, beginning with a strong price rise (flagpole) followed by downward or sideways consolidation (flag). Volume decreases during consolidation and increases when the price breaks higher, signaling to enter long position

ADVANTAGES AND DISADVANTAGES OF THE BULLISH FLAG PATTERN

Advantages:

- High Probability of Continuation: Bullish flag patterns often lead to continued uptrends.

- Clear Entry and Exit Points: The breakout and pullback provide well-defined entry points, and stop-loss and profit targets can be easily set.

- Potential for Significant Gains: If the uptrend continues, bullish flag patterns can offer substantial profit opportunities.

Disadvantages:

- False Breakouts: The price may break above the upper resistance level of the flag but then fail to sustain the upward move.

- Time-Consuming: Identifying and waiting for a bullish flag pattern to form can be time-consuming.

- Market Volatility: Market volatility can affect the accuracy of the pattern and the timing of the breakout.

Some bullish flag pattern example

To illustrate the bullish flag pattern, let's look at a few examples from the stock market:

Tesla Inc. (TSLA): TSLA stock has exhibited multiple bullish flag patterns throughout its history. These patterns have often led to further price appreciation.

Bitcoin (BTC): The cryptocurrency market is also prone to bullish flag patterns. Bitcoin has shown several instances of this pattern, followed by significant price increases.

FINAL THOUGHTS

The bullish flag pattern is a valuable tool for traders who are looking to identify potential continuation patterns in uptrends. By understanding the characteristics of this pattern and applying appropriate trading strategies, traders can increase their chances of success in the market.

However, it's important to remember that no technical analysis tool is foolproof, and market conditions can always change. So traders should remain aware of market conditions to make informed trading choices, consider the overall market context and keep up to date with Klarda now!

Updated 9 months ago