The Evening Star Candlestick Pattern

Learn The Evening Star candlestick pattern with our guide on identification and trading strategies. Enhance your trading by understanding this pattern’s reliability.

The Evening Star candlestick pattern is a crucial tool in technical analysis that helps traders identify potential trend reversals in the market. This article provides an in-depth explanation of the Evening Star pattern, covering how to recognize it and how to trade effectively using this pattern. Explore how mastering the Evening Star can refine your analytical skills and improve your trading strategies.

KEY TAKEAWAYS

- Evening Star Pattern Concept: The Evening Star is a reversal pattern indicating a shift from an uptrend to a downtrend, consisting of three distinct candlesticks.

- How to Identify: The pattern is identified by three candles: a large bullish candle, a small-bodied candle (which could be a doji or any small candle), followed by a large bearish candle.

- Trading Strategy: Consider placing sell orders or initiating short trades when the Evening Star pattern confirms a downtrend reversal.

- Confidence Level: The pattern's reliability increases when combined with other technical indicators and high trading volume.

WHAT IS THE EVENING STAR CANDLESTICK PATTERN ?

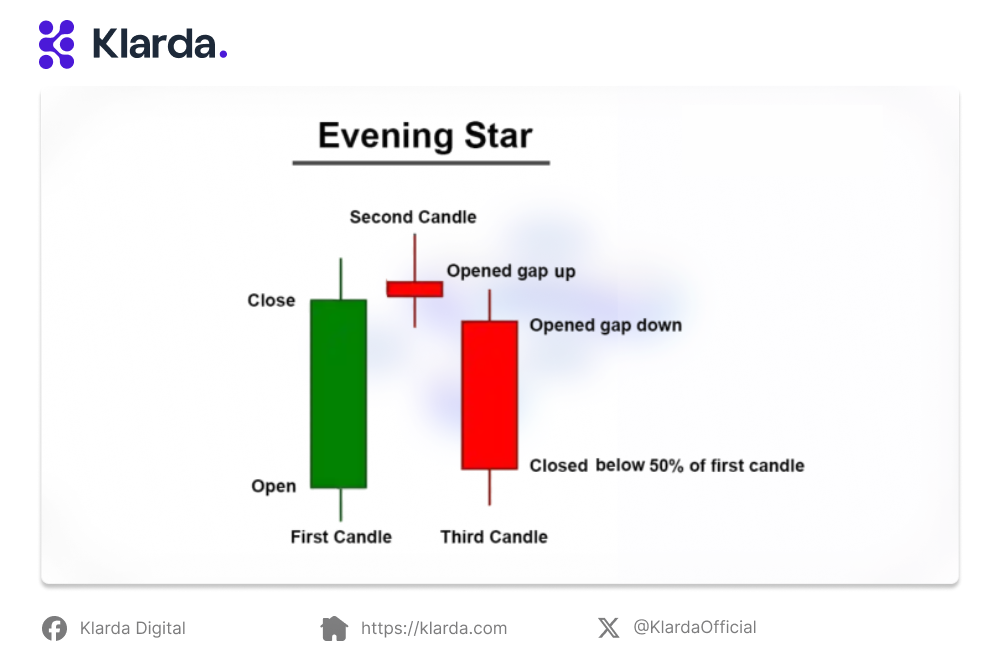

The Evening Star, also known as the Evening Star candlestick pattern, is a highly potential reversal signal in trading. This pattern consists of three candles: the first is a large bullish candle, the second can be either bullish or bearish, and the third is a large bearish candle. The Evening Star pattern indicates that the price is likely to decline. The shape and characteristics of the Evening Star are entirely opposite to those of the Morning Star pattern. Furthermore, for a pattern to be identified as an Evening Star, it must meet the following conditions:

- It occurs at the end of an uptrend.

- The first candle must be a long bullish candle.

- The second candle should be a short green or red candle, signaling hesitation. Longer shadows on this candle suggest a higher likelihood and strength of reversal.

- The third candle is a long red candle that indicates the start of a trend reversal, with price action moving beyond the control of buyers.

Today, the Evening Star candlestick pattern is applied across various financial markets such as stocks, forex, and cryptocurrencies, and is widely used. What makes the Evening Star one of the favorite candlestick patterns for traders is its easy visual recognition. Although there are many different candlestick patterns, the Evening Star is particularly straightforward to identify.

HOW TO IDENTIFY THE EVENING STAR CANDLESTICK PATTERN IN TRADING?

Identifying the Evening Star candlestick pattern on a chart involves more than just spotting the three main candlesticks. It requires understanding the prior price action and where the pattern appears within the current trend.

Establish an Existing Uptrend: The market should show higher highs and higher lows.

- Large Bullish Candle: A large bullish candle indicates significant buying pressure, continuing the current uptrend. At this stage, traders should only look for long trades as there is no evidence of a reversal yet.

- Small Bearish/Bullish Candle: The second candle is small—often a Doji—showing the first signs of trend fatigue. This candle typically has a higher open, creating a higher high. It doesn't matter if the candle is bearish or bullish; what’s important is that the market shows indecision.

- Large Bearish Candle: The true sign of new selling pressure is revealed in this candle. In non-forex markets, this candle closes below the previous candle's close, signaling the beginning of a new downtrend.

- Subsequent Price Action: After a successful reversal, traders should look for lower lows and lower highs while managing the risk of potential failures with well-placed stop-losses.

HOW TO TRADE THE EVENING STAR CANDLESTICK PATTERN?

Looking at the chart, once the Japanese candlestick pattern is complete, traders can enter the market when the pattern has formed. More conservative traders might wait and see if the price action indeed declines. However, the downside is that they might enter at a significantly worse price, especially in fast-moving markets.

To trade the Evening Star candlestick pattern, follow these steps:

- Identify the Evening Star Pattern: Look for three consecutive candles on the chart. The first is a large bullish candle, the second is a small candle or a bullish/doji candle that may gap into the body of the first candle, and the third is a large bearish candle that potentially gaps into the body of the second candle.

- Confirm the Pattern: To confirm the Evening Star pattern, check additional factors. This may include observing increased trading volume while the pattern forms, confirmation from other technical indicators like moving averages or MACD, and considering the pattern's position within the overall trend.

- Place a Sell Order: Once the Evening Star pattern is confirmed, you can place a short sell order or sell when the price drops below the low of the third bearish candle. Profit targets can be set using subsequent support levels on the chart or other technical analysis tools.

- Manage Risk: Always manage risk by setting a stop-loss to limit potential losses if the market moves against your prediction. You can also use other risk management techniques, such as trailing stops, to lock in profits as the price declines.

Note that the Evening Star candlestick pattern does not guarantee success. It is just a tool in technical analysis and should be considered along with other factors.

CONFIDENCE LEVEL OF EVENING STAR CANDLESTICK PATTERN

The Evening Star candlestick pattern is a commonly occurring pattern in financial markets. This pattern is easy to identify and has relatively simple trading rules. However, if the Evening Star reversal fails, the price may continue to rise. Therefore, always set a stop-loss and manage risk appropriately.

Enhance Your Trading with Klarda App

To enhance your trading skills and apply insights from the Evening Star candlestick pattern effectively, consider using the Klarada app. Klarada offers advanced charting tools and real-time market analysis, making it easier to spot and act on patterns like the Evening Star. With Klarada, you can seamlessly integrate technical analysis into your trading strategy and make informed decisions. Download the Klarada app today and elevate your trading experience.

The Klarda App has two versions: a web browser version and a mobile app version.

- Web browser version: https://klarda.com/

- Mobile app version for iOS: https://apps.apple.com/ua/app/klarda-crypto-and-portfolio/id6471593752

- Mobile app version for Android: https://play.google.com/store/apps/details?id=com.klarda.app

Note: Both versions have the above features.

The Evening Star candlestick pattern not only offers clear signals for trend reversals but also provides valuable trading opportunities. Understanding how this pattern works and its reliability can help you make smarter trading decisions and enhance your investment strategies. Equip yourself with the essential knowledge to fully utilize the power of the Evening Star pattern in your trading approach.

Updated 9 months ago