What is Bullish Engulfing Candlestick Pattern? How to trade with it?

The candlestick pattern is a common formation on price charts consisting of two opposing candles. But what exactly are they?

The Bullish Engulfing Candlestick Pattern is highly regarded for its effectiveness in short-term trading. However, many investors still do not fully understand this candle pattern. Therefore, today we will help you gain a better understanding of this issue.

KEY TAKEAWAY

- "Bullish" means an upward trend, and "Engulfing" means something that fully covers. Therefore, the Bullish Engulfing pattern indicates a strong bullish reversal

- The Bullish Engulfing pattern consists of a bearish candle followed by a larger bullish candle that engulfs the previous one.

- Several additional factors can enhance the success rate when trading with this pattern.

- The Bullish Engulfing pattern is popular for its advantages, but it also has some drawbacks.

- Trading with this pattern requires at least three steps.

WHAT IS THE BULLISH ENGULFING CANDLESTICK PATTERN?

The term "Bullish" signifies an upward trend, while "Engulfing" refers to something that completely covers or engulfs. Thus, the Bullish Engulfing pattern is known as a bullish engulfing candle, indicating a powerful bullish reversal.

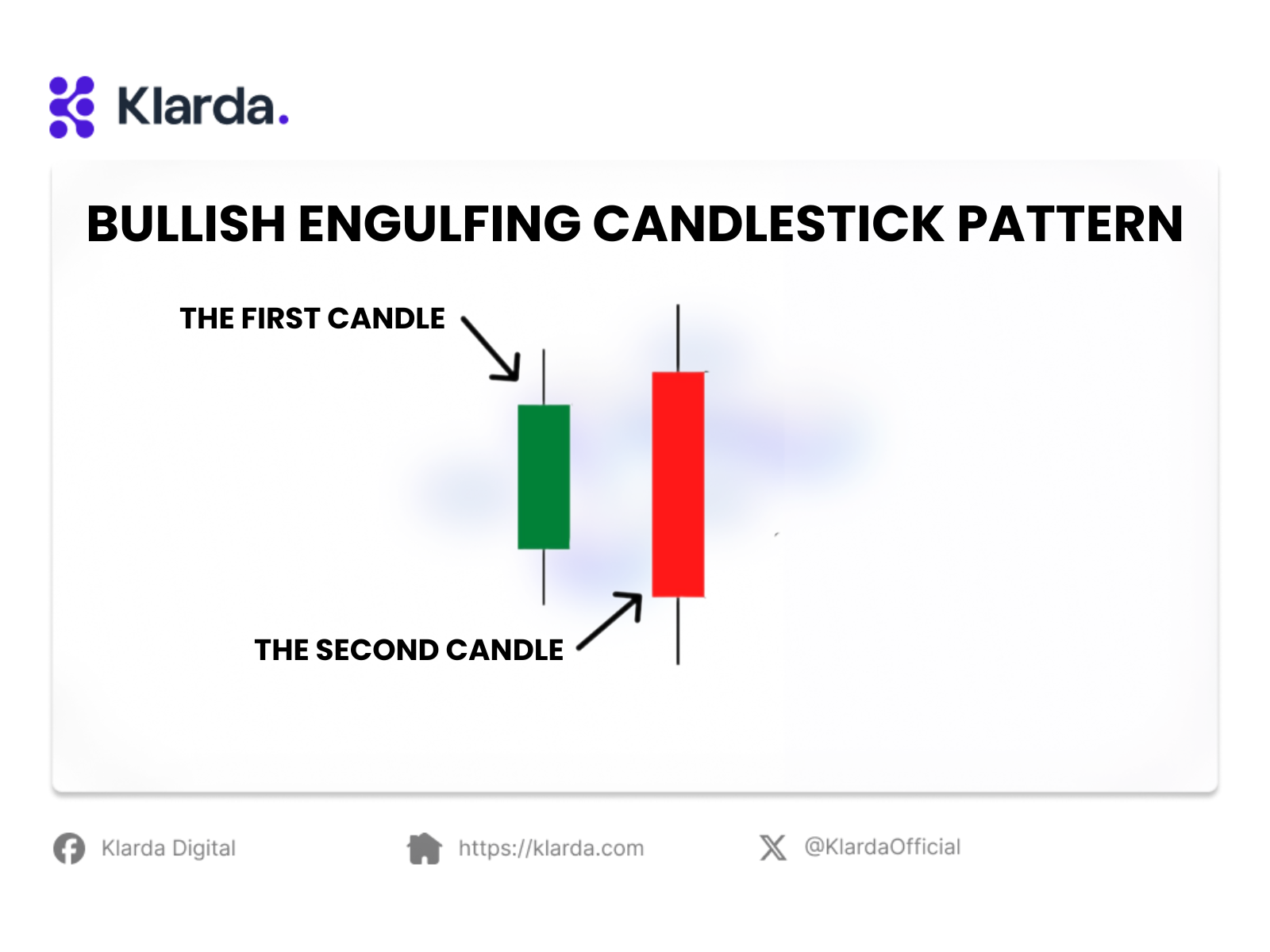

The Bullish Engulfing pattern has two candles:

- The first candle: A bearish candle with a short and narrow body.

- The second candle: A bullish candle with a long body that completely engulfs the first candle.

FEATURES OF THE BULLISH ENGULFING CANDLESTICK PATTERN

The Bullish Engulfing pattern consists of two candles, making it easy to identify:

- The first candle: A bearish candle, where the closing price is lower than the opening price.

- The second candle: is a bullish one, opening below the first candle’s close and closing well above the first candle’s open.

In summary, the second candle's body must fully cover the first candle's body.

FACTORS ENHANCE THE EFFECTIVENESS OF THE BULLISH ENGULFING PATTERN

In addition to the basic structural factors of a Bullish Engulfing pattern mentioned earlier, there are several other factors that can improve the success rate of trading with this pattern:

- The second candle should be significantly larger than the first candle. The first candle should be small to indicate that the downtrend is losing strength and momentum.

- The Bullish Engulfing pattern should occur after a strong downtrend. If it appears during a sideways market, it may not be as effective and might just be a result of random candle formations.

- The second candle’s volume should be much higher than the first and ideally exceed several prior candles, signaling strong buying pressure and a higher chance of trend reversal.

- The Bullish Engulfing pattern occurring at a strong support level enhances the reliability of the signal.

- The second candle should have a body larger than several preceding candles.

PROS AND CONS OF BULLISH ENGULFING PATTERN

The Bullish Engulfing candle pattern is favored by many traders due to the following advantages:

- Ease of Identification: The second candle must be significantly larger to completely engulf the first candle, making the pattern easy to spot.

- High Winning Potential: Once identified, you can quickly calculate entry points with a higher likelihood of success.

However, the Bullish Engulfing pattern also has some drawbacks:

- Limited Forecasting: It only indicates a potential reversal and upcoming price increase but does not provide information about the duration or extent of the price rise.

TRADING WITH THE BULLISH ENGULFING PATTERN

Step 1

First, identify the trend. If the price is continuously failing to make a lower low compared to the previous low, it indicates that the downtrend is weakening. At this point, look for the appearance of the Bullish Engulfing candle pattern.

Step 2

The Bullish Engulfing pattern, used traditionally in securities, has some differences in crypto trading. Typically, it requires the second candle to open lower than the closing price of the first. However, due to the 24/7 nature of crypto markets, this is less common.

In crypto, the Bullish Engulfing often features two equal lows. Ideally, the right side of the candle should be lower than the left, indicating a slight dip before a strong price increase.

Step 3

To ensure safety, confirm the Bullish Engulfing signal with additional methods like moving averages, support lines, or subsequent green candles.

Once confirmed, buy at the opening price of the next candle and set a stop-loss just below the lower wick of the Bullish Engulfing candle.

Set a target at least twice the distance from the stop-loss, providing a 1:2 risk-reward ratio, so even a 50% win rate remains profitable.

And that concludes all the information we have gathered about the Bullish Engulfing candlestick pattern. It is a crucial pattern that every trader should understand to avoid losing money due to mistakes. However, for beginners, getting familiar with these patterns can be challenging. Therefore, we introduce you to the Klarda app—a convenient app that allows you to monitor the market anytime, anywhere, on your phone or web.

Updated 10 months ago