Three Black Crows Pattern

The Three Black Crows pattern consists of three consecutive bearish candles. This article will explain its significance and trading function.

The Three Black Crows Candlestick pattern is a candlestick formation consisting of three consecutive bearish candles. While it may seem straightforward, understanding its significance and how it operates can be more complex. This article will delve into the meaning of the pattern, its implications for market trends, and how it can be used in trading strategies.

KEY TAKEAWAY

- The Three Black Crows is a bearish pattern of three consecutive black candles, indicating a potential reversal from an uptrend to a downtrend.

- To identify the Three Black Crows pattern, look for three consecutive bearish candles with long bodies and short wicks, forming at the end of an uptrend or during a price correction, with consistent body lengths, and gaps between candles being less critical in highly liquid markets.

- The Three Black Crows pattern is rarely used in trading due to its limitations, such as signaling a downtrend that's already advanced, the possibility of a trend reversal, and the effectiveness of analyzing the first candle's interaction with previous candles for better entry and stop-loss points.

- The table below highlights the Three Black Crows pattern's high success rate, clear identification, and versatility, but also notes its delayed confirmation and the risk of signals during market shifts.

WHAT IS THE THREE BLACK CROWS CANDLESTICK PATTERN?

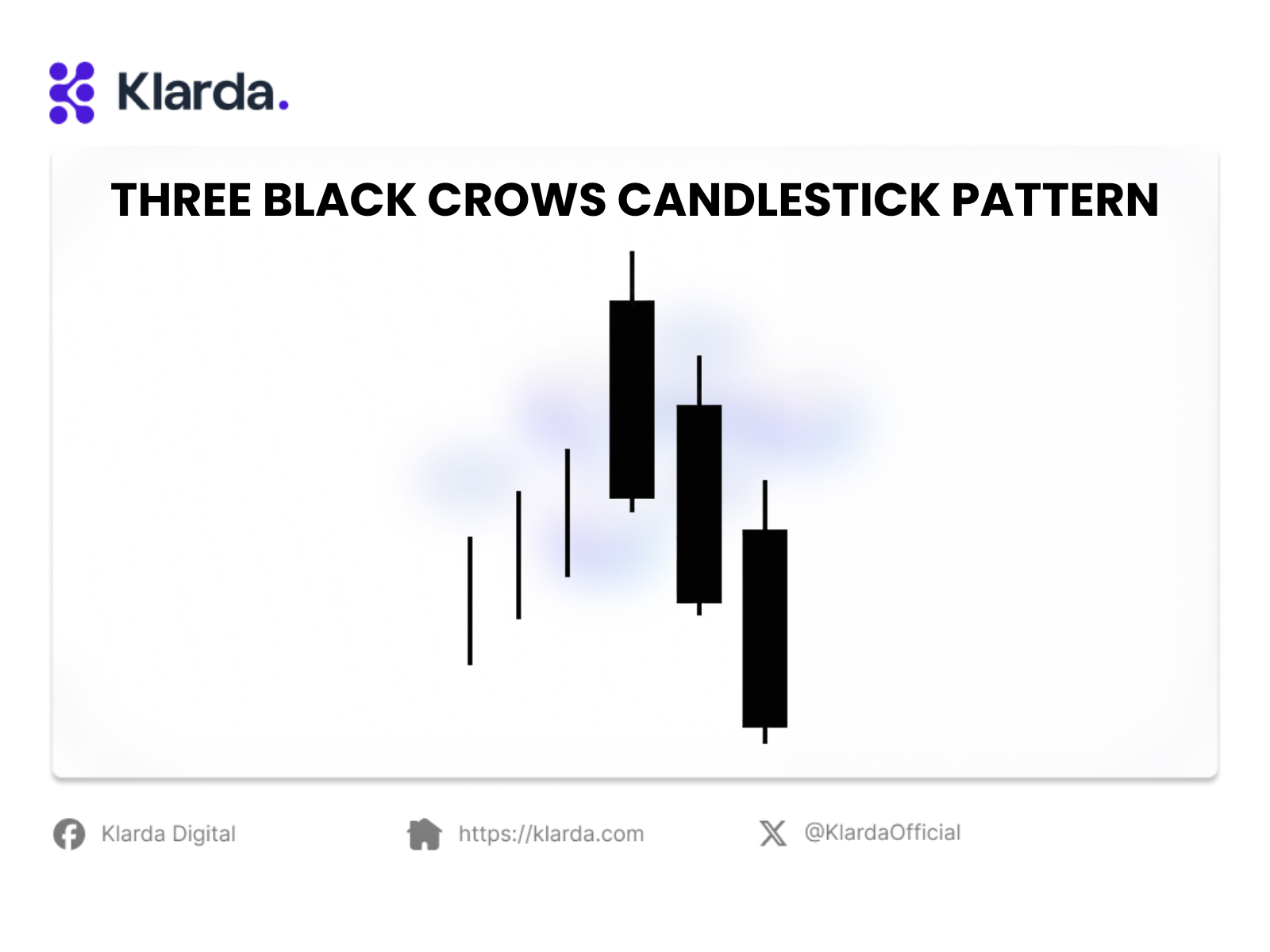

The Three Black Crows is a candlestick pattern consisting of three consecutive bearish candles. The name is derived from the traditional use of black candles to represent downward movement and white candles for upward movement in candlestick charts.

The imagery of the black crows reflects their behavior of descending to attack prey, symbolizing a bearish trend. This pattern indicates a possible shift from an uptrend to a downtrend, akin to the Hanging Man pattern. It is associated with market declines and is often viewed as a negative signal by traders.

FEATURES OF THREE BLACK CROWS CANDLESTICK PATTERN

As mentioned, the Three Black Crows candlestick pattern is visually recognizable. However, to accurately identify this pattern and capture reliable trading signals, investors should be aware of the following key features:

Candlestick Characteristics

The pattern consists of three consecutive red (bearish) candles, each with long bodies and very short or nearly non-existent wicks.

Body Length Consistency

The pattern is more reliable if the length of the candle bodies is approximately equal or progressively increasing.

Formation Context

The pattern usually forms at the end of an uptrend or during a downtrend correction. Although the ideal pattern includes gaps between each candle (where the opening price of each candle is higher than the closing price of the previous one), in highly liquid markets, these gaps may not always appear. In such cases, the exact formation of gaps is less critical.

Market Position

The Three Black Crows pattern can also appear at the end of a price rally within a downtrend or after a significant uptrend.

TRADING WAYS WITH THE THREE BLACK CROWS CANDLESTICK PATTERN

In practice, the Three Black Crows pattern is rarely used in trading, despite the various Price Action strategies discussed on this website. This is due to several limitations that make the pattern less suitable for trading:

Trend Limitations

When three consecutive bearish candles form, it indicates that the downtrend has already progressed significantly. This often leads to price retracements after the Three Black Crows pattern, making it challenging to set a stop loss effectively.

Trend Reversal

Three bearish candles in a row can sometimes signal the end of a downtrend and the beginning of an uptrend.

Combination with Previous Candles

The first bearish candle in the Three Black Crows pattern might interact with the preceding candle to form another pattern. Analyzing and trading based on this initial candle can be more effective, as it provides both entry and stop loss points. For instance, in the second example of the pattern, the first candle could form a bearish engulfing pattern with the prior candle.

These factors highlight why the Three Black Crows pattern may not always be the best choice for trading and why alternative methods are often preferred.

PROS AND CONS THREE BLACK CROWS CANDLESTICK PATTERN

The table below outlines the advantages and limitations of the Three Black Crows pattern:

Advantages:

- High Success Rate: Research indicates that this pattern has a success rate of over 70%.

- Clear Identification: It is easily recognizable on candlestick charts.

- Flexibility: The pattern can be applied to a variety of asset types.

Limitations:

- Delayed Confirmation: The pattern requires the formation of three consecutive bearish candles, which may take time and delay confirmation.

- Market Shifts: Signals may appear when the price fails to continue falling, often due to abrupt changes in market sentiment.

That’s all on the Three Black Crows pattern. We hope this helps you understand the phase after an uptrend. For reliable information, try the Klarda app, which offers excellent features.

Updated 10 months ago