Double Bottom Pattern

Learn how to identify, trade, and profit from the double bottom pattern, a powerful indicator of trend reversals and market shifts.

The Double Bottom Pattern is one of the few that effectively signals a reversal in market direction. Resembling the letter 'W,' this chart pattern can be used by investors to capitalize on market shifts.

This post outlines the specifics of the double bottom pattern, including how to identify it, as well as its advantages and drawbacks.

KEY TAKEAWAYS

- A double bottom is a chart pattern in asset prices that forms a W-shaped movement, signaling a potential significant price increase following two lows.

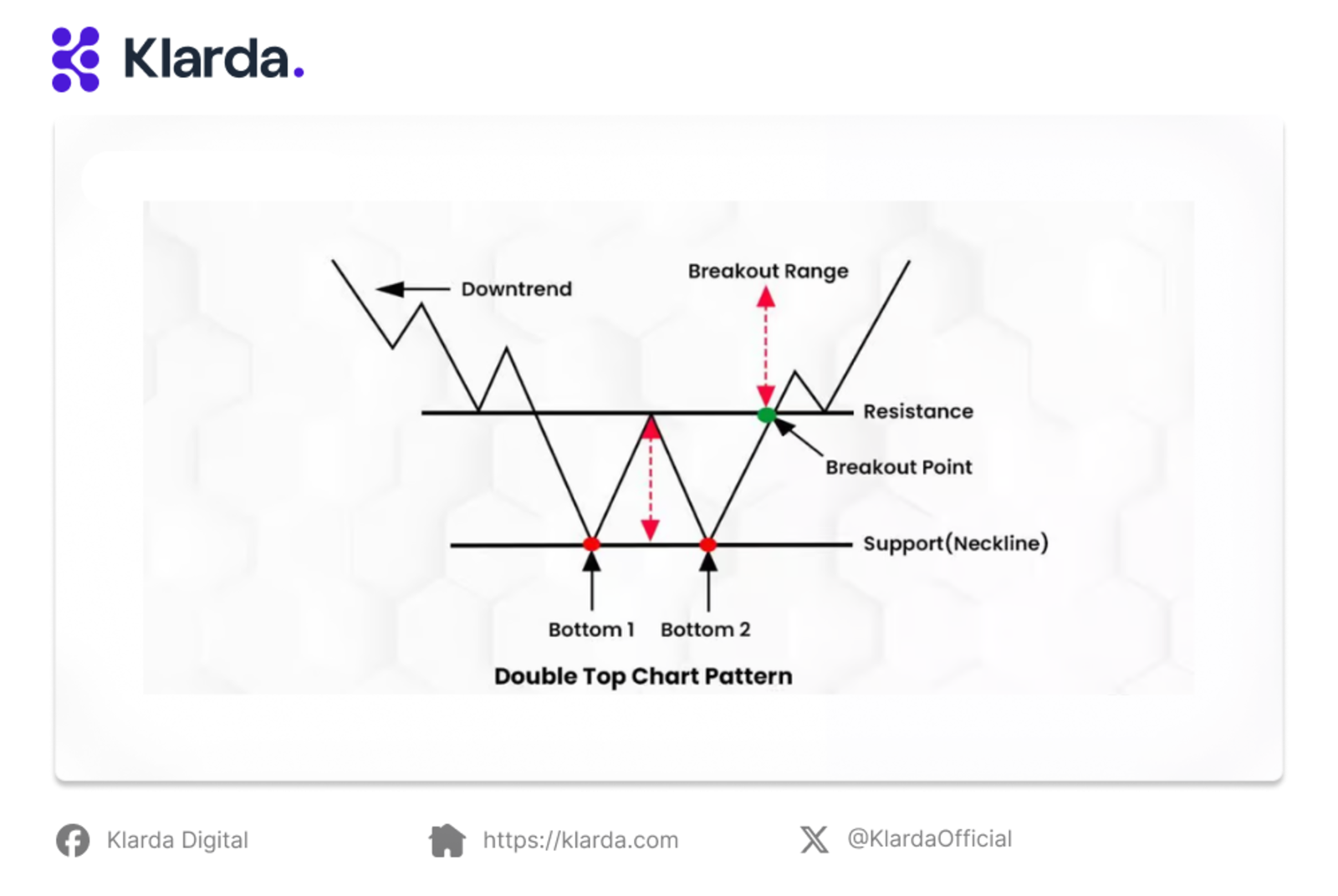

- Conversely, a double top pattern represents the opposite, suggesting a significant price decline after reaching two highs.

- Traders looking to capitalize on a double bottom typically enter their positions at the second low, betting that the pattern will hold and lead to an upward trend.

WHAT IS DOUBLE BOTTOM PATTERN?

What is double bottom pattern?

The double bottom pattern is a well-known technical analysis charting formation that signals a significant shift in trend and a reversal in momentum following a previous downtrend.

It involves a decline in the price of a security or index, a rebound, another decline to the same or similar level as the initial drop, and a final rebound, which could potentially lead to a new upward trend.

Visually, the pattern resembles the letter "W." The two lows mark a crucial support level, and as long as these lows are maintained, there is potential for upward movement.

For profit targets, a cautious approach suggests that the minimum price target should be the distance between the two lows plus the height of the intermediate high. More aggressive targets might be twice the distance between the two lows and the intermediate high.

DOUBLE BOTTOM PATTERN STRUCTURES

Double pattern structures

The Double Bottom pattern occurs when the price drops to a low, rebounds, and then drops again to retest the previous low. The key characteristics of a Double Bottom are:

- Two Lows: The price forms two similar lows, resembling the letter "W."

- Neckline: A horizontal line drawn at the highest point between the two lows.

- Breakout: The pattern is confirmed when the price breaks above the neckline.

A Double Bottom suggests that selling pressure has weakened, and buyers are gaining control. When the price breaks above the neckline, it indicates a potential shift from a downtrend to an uptrend.

Important considerations for identifying a valid Double Bottom include:

- Timeframe: The time between the two lows should be sufficient to indicate a change in market sentiment.

- Volume: Increasing volume during the breakout can strengthen the bullish signal.

- Other Technical Indicators: Combining the Double Bottom with other technical indicators, such as moving averages or relative strength index (RSI), can provide additional confirmation.

HOW TO TRADE DOUBLE BOTTOM PATTERN?

When trading the double bottom pattern, it's important to consider the time and space between the two lows—the greater the gap, the more significant the pattern tends to be. A wider gap attracts more traders, increasing the potential for a stronger upward move.

Here’s a strategy to profit from "trapped" traders using this concept:

- Ensure there is sufficient time and distance between the first and second lows.

- Allow the price to briefly drop below the first low.

- Wait for a reversal from lower prices before entering a long position.

Example:

"Trapped" traders example

When the price breaks below the first low, bearish traders might enter short positions, placing their stop-loss orders above the lows. If the price quickly rebounds, these short traders can get "trapped" with their stops in play.

You can capitalize on this by going long, as the upward movement could trigger their stop-losses and drive the price higher, benefiting your position.

That’s the approach to trading the double bottom pattern!

STRENGTHENS AND WEAKNESSES

Strengths:

- The double bottom is a powerful reversal pattern due to its relative rarity.

- It is highly effective in forecasting a trend reversal.

- The pattern provides a clear and well-defined level for trading decisions.

Weaknesses:

- There is a risk that the market may continue in its existing direction.

- It should be used in conjunction with other indicators to confirm the pattern's validity.

THE BOTTOM LINE

Double bottom formations are powerful indicators of longer-term trend reversals, suggesting a significant low has been reached. Typically, this pattern indicates a potential rebound of 10% to 20% after the second low, with more upside possible if fundamentals improve. Using longer-term charts, such as daily or weekly, is the best way to spot double bottoms. The lows should ideally be within 3% to 4% of each other.

A confirmed double bottom occurs when the price retests downside support with a second low, followed by a break above the high in the middle of the pattern, signaling further upside and a possible new uptrend.

And to make the most of these opportunities, start using Klarda App today to stay ahead of the curve and turn your trading strategies into successful outcomes.

The Klarda App has two versions: a web browser version and a mobile app version.

- Web browser version: https://klarda.com/

- Mobile app version for iOS: https://apps.apple.com/ua/app/klarda-crypto-and-portfolio/id6471593752

- Mobile app version for Android: https://play.google.com/store/apps/details?id=com.klarda.app

Updated 10 months ago