Descending Triangle Pattern

Explore the descending triangle pattern, its bearish and bullish signals, and strategies for effective trading and identification.

The descending triangle pattern is a key technical analysis pattern, often indicating bearish trends. Defined by a descending upper trendline and a horizontal lower trendline, it helps traders predict potential breakdowns and market shifts. This article will cover how to identify and trade descending triangles, along with their implications for both bearish and bullish scenarios.

KEY TAKEAWAYS

- A descending triangle suggests that traders might consider taking a short position to capitalize on a potential breakdown.

- This pattern can be identified by drawing trend lines connecting the highs and lows on a chart.

- It serves as the opposite of an ascending triangle, which is another chart pattern used by technical analysts based on trend lines.

WHAT IS THE DESCENDING TRIANGLE PATTERN?

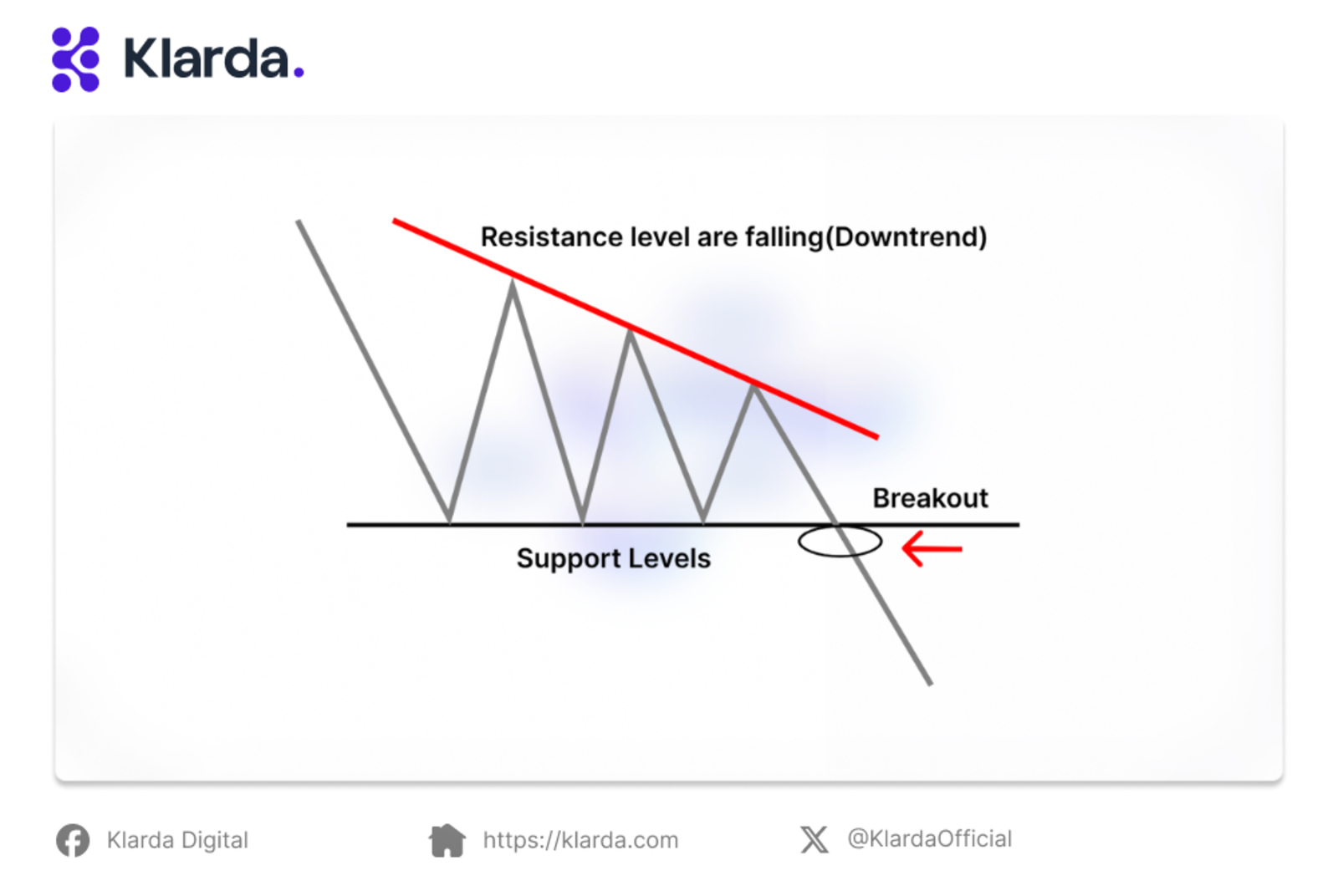

Descending triangle pattern

In technical analysis, a descending triangle is a chart pattern formed by drawing a trend line that connects a series of lower highs and another horizontal trend line that connects a series of lows.

Typically, a descending triangle is seen as a bearish or continuation pattern in an existing downtrend. However, it can also act as a bullish signal if a breakout occurs in the opposite direction, making it a reversal pattern as well.

What Does a Descending Triangle Tell You?

Descending triangles, a common chart pattern among traders, indicate weakening demand for an asset, derivative, or commodity. When the price falls below the lower support level, it signals that downward momentum may persist.

Technical traders can capitalize on this by closely monitoring for a break below the support trend line, which suggests increasing downward momentum and an impending breakdown. This often prompts traders to take short positions, aiming to drive the asset's price even lower.

HOW TO IDENTIFY DESCENDING TRIANGLE?

Descending triangles have distinct characteristics that traders and investors can use to easily identify them. These features are applicable in both financial and foreign exchange markets.

Identifying a Descending Triangle

- Existing Downtrend: Before the descending triangle pattern forms, the market must already be in a downtrend.

- Consolidation Phase: The descending triangle emerges when the market enters a consolidation phase.

- Descending Upper Trendline: This trendline, which slopes downward, is created by connecting the higher points and indicates that sellers are gradually driving prices lower.

- Horizontal Lower Trendline: The lower horizontal trendline serves as support, with prices often nearing this level until a breakout occurs.

- Continued Downtrend: After breaking below the lower trendline, the market typically continues its downward movement.

HOW TO TRADE A DESCENDING TRIANGLE?

Traders typically enter a short position after a high-volume breakdown below the lower support line in a descending triangle pattern. The price target is usually calculated by subtracting the vertical height of the triangle at the breakdown from the entry price. The upper trend line often serves as a stop-loss level to manage potential losses.

Let’s take a look at these strategies below:

- Breakout Strategy: This strategy focuses on capturing short-term profits by anticipating a breakout from the descending triangle, using trading volumes and trend confirmation.

- Heikin-Ashi Charts: Traders use Heikin-Ashi charts to identify trends within the descending triangle pattern, waiting for bullish signals before the breakout.

- Moving Averages: By combining the descending triangle pattern with moving average indicators, traders can time their trades more effectively when a breakout is expected.

- Reversal Pattern—Top: This pattern signals the end of a bullish phase, with traders entering positions as the descending triangle forms and volume declines.

- Reversal Pattern—Bottom: At the bottom of a downtrend, this pattern suggests a potential upside breakout, prompting traders to consider long positions if the price action breaks upward.

DESCENDING TRIANGLES VS ASCENDING TRIANGLES

Ascending and descending triangles are continuation patterns. The descending triangle has a horizontal lower trend line and a descending upper line, while the ascending triangle has a horizontal upper line and a rising lower trend line.

Both patterns suggest shorting opportunities and profit targets. Although ascending triangles can indicate a downtrend reversal, they are more commonly viewed as bullish continuation patterns.

ADVANTAGES AND DISADVANTAGES OF DESCENDING TRIANGLE

Descending triangle patterns are advantageous due to their easy identification and clear target level based on the triangle's maximum height.

However, they carry the risk of false breakdowns, where the downtrend reverses unexpectedly. Prices can also move sideways or rise, defying the typical pattern, and trend lines may need adjustment if prices break out in the opposite direction.

DESCENDING TRIANGLE EXAMPLE

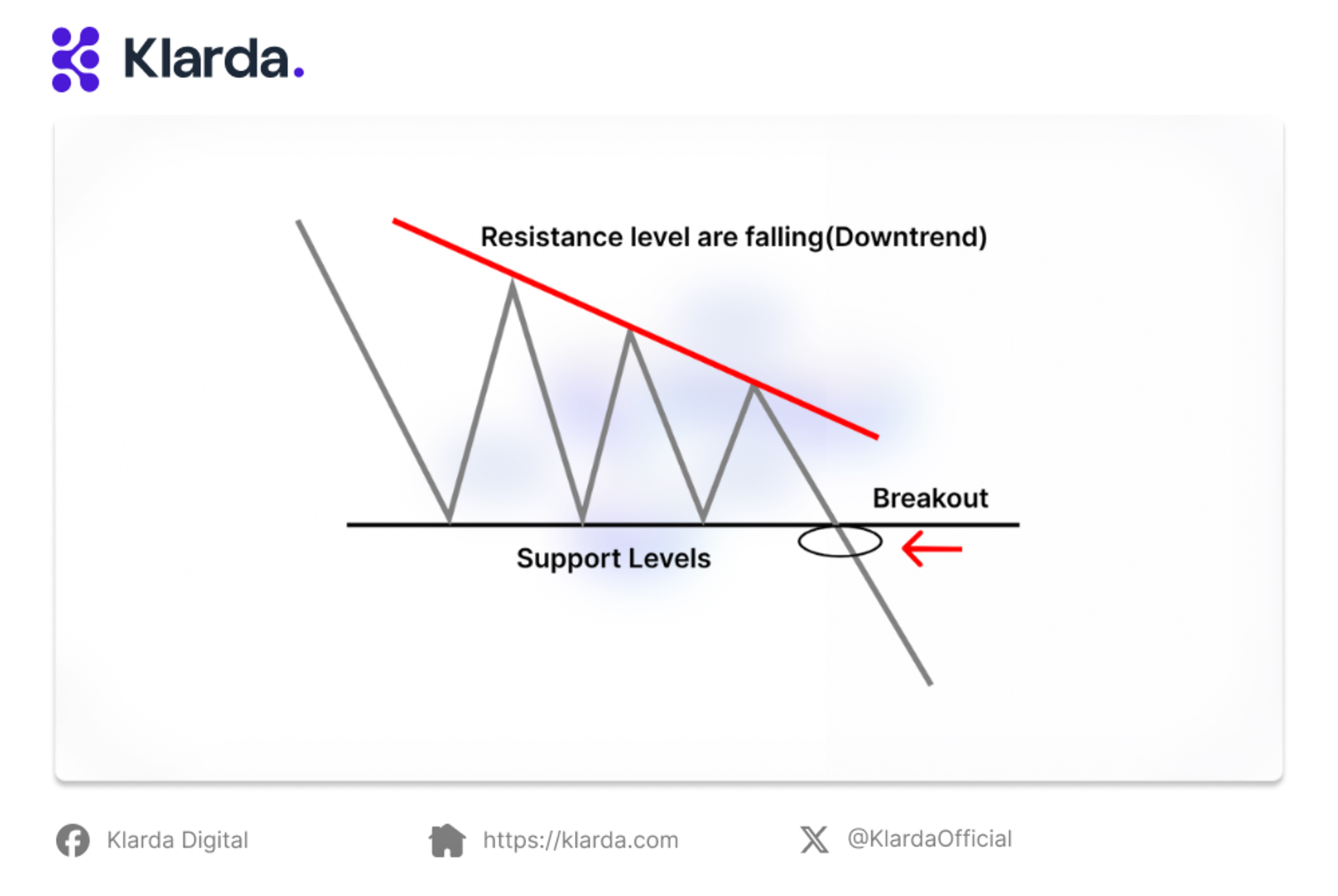

A descending triangle is a bearish chart pattern characterized by a horizontal support line and a downward sloping trendline. The narrowing price range between these lines suggests a period of indecision before a potential breakdown.

This example below illustrates how a descending triangle formed. Let’s take a look!

Descending triangle example

THE BOTTOM LINE

In conclusion, the descending triangle is a chart pattern in technical analysis, often forming at the end of a downtrend or as consolidation during an uptrend. Generally, it's seen as a bearish pattern within a downtrend, but a breakout in the opposite direction can signal a bullish reversal.

Understanding the various types of descending triangle patterns can be challenging for new investors. In such cases, Klarda becomes a perfect choice. Klarda's product pages offer comprehensive information, including price history, news, social media trends, and potential risks/rewards. Explore Klarda's user-friendly features for better decision-making in your investments.

Updated 10 months ago