The Shooting Star Pattern

Explore the Shooting Star candlestick pattern—a crucial reversal signal in technical analysis. Learn how to identify, read, and trade this pattern effectively to optimize your investment results.

In the world of technical analysis, the Shooting Star candlestick pattern is considered one of the most powerful reversal signals. Characterized by a small candle body with a long upper shadow, it often appears at the peak of an uptrend. Understanding and correctly identifying this pattern will help investors make accurate trading decisions, seize profit opportunities, and minimize risks. This article will provide you with all the necessary information about the Shooting Star pattern, from its structure and interpretation to effective trading strategies.

KEY TAKEAWAYS

- The Shooting Star candlestick pattern is a significant reversal signal, typically appearing at the peak of an uptrend.

- The structure of the candle includes a small body and a long upper shadow, indicating the buyers' failure to push the price higher.

- Correctly reading the Shooting Star pattern helps identify potential reversal points in the market.

- Applying this pattern in your trading strategy can help investors maximize profits and minimize risks.

WHAT IS THE SHOOTING STAR CANDLESTICK PATTERN?

The Shooting Star candlestick is a single candlestick pattern characterized by a relatively small body and a long upper shadow, which is usually much longer than the body itself. Because of this, the pattern is also known as the "Shooting Star" or "Falling Star" candlestick.

The shape of the Shooting Star candlestick is identical to that of the Inverted Hammer, with its small body and long upper shadow. However, the key difference between these two patterns lies in the market signal they indicate. While the Inverted Hammer suggests a bullish reversal, the Shooting Star signals a reversal from an uptrend to a downtrend.

HOW IS A SHOOTING STAR CANDLESTICK PATTERN STRUCTURED?

As mentioned above, this candlestick pattern indicates a bearish trend signal. Moreover, because it resembles the inverted hammer candlestick, investors must thoroughly understand the characteristics and significance of this pattern to avoid making incorrect decisions.

Some characteristics of the Shooting Star candlestick:

- The candlestick has a small body, positioned near the bottom (due to the close proximity of the opening and closing prices).

- The upper shadow is at least twice as long as the body.

- The lower shadow is the shortest part, which may or may not be present.

- This candlestick pattern often appears at the peak of an uptrend, signaling a potential decline.

- The candlestick is usually green or red; however, if it is red, the reversal signal is even stronger.

This pattern is commonly used by new investors due to its identifiable features. However, the Shooting Star should not be used alone in selling transactions; it should be combined with other techniques to accurately determine the timing.

HOW TO READ SHOOTING STAR CANDLESTICK PATTERN IN TECHNICAL ANALYSIS?

In technical analysis, understanding a Shooting Star candlestick pattern involves three key considerations.

First, observe the price advance. A Shooting Star typically appears at the end of an uptrend, where the price rises sharply after the market opens. This increase signals strong buying pressure during the prior bullish trend, as reflected in the long upper wick.

Second, pay attention to the subsequent rapid price drop. Later in the session, the price falls significantly, closing near the opening level, which creates a small body and a long upper shadow. This decline indicates that sellers have gained control, pushing the price back down.

Third, confirm the trend reversal. To validate the bearish signal, check the candlesticks that follow the Shooting Star. If they show a downward trend with lower closing prices, it confirms the market has shifted from bullish to bearish. The reliability of the Shooting Star pattern largely depends on this confirmation from subsequent price action.

HOW TO TRADE THE SHOOTING STAR CANDLESTICK PATTERN?

Step 1 - Identify the Trend: The Shooting Star candlestick only provides a signal for a reversal from an uptrend to a downtrend, but it’s not a very strong signal. Therefore, traders need to calmly assess where the candlestick is in the trend and whether there are any signs of weakness.

Step 2 - Place the Order: If, after an uptrend, two candlesticks appear (with the first one not being enough to conclude), and all other technical analysis indicates that the market is starting to decline, investors should quickly enter a sell order as soon as the third candlestick is completed.

Step 3 - Set Stop Loss and Take Profit: If the market moves downward, a Stop Loss will help investors protect their capital and the profits already made. The stop loss point is typically set above the top of the candlestick, usually calculated as 2 or 3 times the stop loss distance.

Similarly, when the market rises to a certain level, investors should "take profit" to ensure they secure their gains. The take profit distance should be two or three times the stop loss distance.

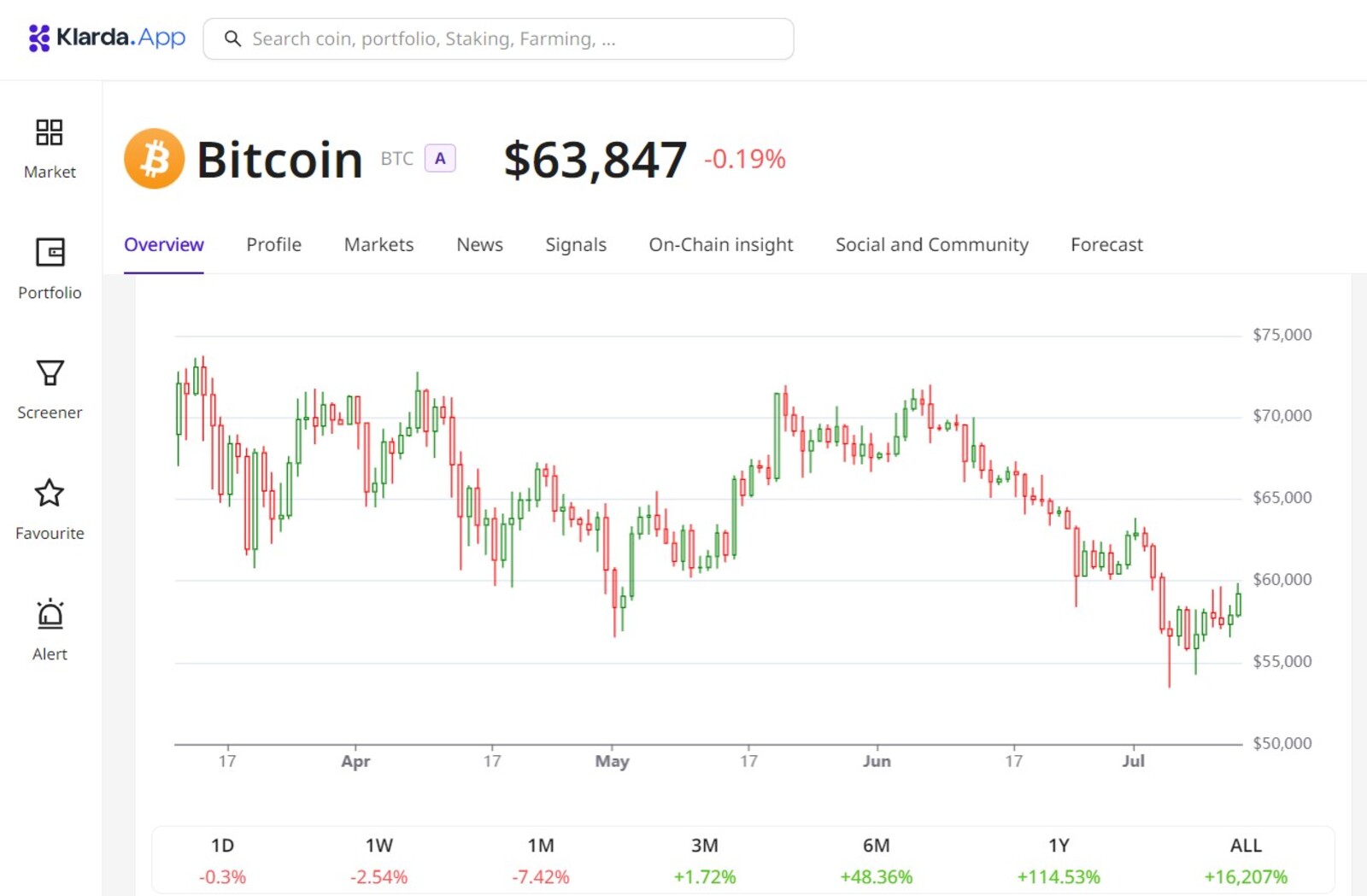

Klarda App is a powerful tool designed to support investors in technical analysis and optimizing trading strategies. With its robust features, Klarda App makes it easy for you to identify and understand crucial candlestick patterns like the Shooting Star. By providing detailed insights and in-depth analysis, Klarda App not only helps you make informed investment decisions but also enhances your trading skills, allowing you to maximize profits and minimize risks in the market. Discover how Klarda App can be your trusted companion in your investment journey through the following article on the Shooting Star candlestick pattern.

The Klarda App has two versions: a web browser version and a mobile app version.

- Web browser version: https://klarda.com/

- Mobile app version for iOS: https://apps.apple.com/ua/app/klarda-crypto-and-portfolio/id6471593752

- Mobile app version for Android: https://play.google.com/store/apps/details?id=com.klarda.app

Note: Both versions have the above features.

Recognizing and thoroughly understanding the Shooting Star candlestick pattern is not only an essential skill for professional investors but also a valuable tool for anyone looking to improve their trading results. By combining knowledge of this pattern with other technical analysis tools, you can increase your chances of success in a volatile market. Always practice and test your strategies on a demo account before applying them to live trading to ensure safety and effectiveness.

Updated 10 months ago