Bearish Pennant Pattern

Discover the bearish pennant pattern: its definition, psychological aspects, and tips for successful trading in our comprehensive guide.

There are various chart patterns that stock traders rely on to make informed trading decisions. In this guide, we'll concentrate on the bearish pennant pattern, a formation that frequently indicates a downtrend and can be used to anticipate price changes. We will explore the psychology behind this pattern and provide insights on how to trade it effectively.

KEY TAKEAWAYS

- A bearish pennant is a continuation pattern that appears during a downward price trend.

- This pattern develops when there is a strong downtrend followed by a brief correction, marked by smaller candlesticks that converge.

- The resulting price action forms a triangular shape, signaling consolidation.

- A bearish pennant has three key features: the flagpole, the pennant, and the breakout.

WHAT IS A BEARISH PENNANT PATTERN?

What is the bearish pennant pattern?

A bearish pennant pattern is a technical analysis tool used to predict potential price drops in the stock market. This pattern forms after a downtrend, followed by a brief consolidation, where the highs and lows create a symmetrical triangle. A downside breakout from this triangle typically signals that the downtrend will continue.

Understanding the psychology behind this pattern is key. Bearish pennants often arise during times of market uncertainty or fear, when traders hesitate to take new positions due to unclear price direction. This leads to the consolidation phase that forms the pennant. The breakout from the triangle generally happens quickly and suggests a continuation of the downtrend.

Flags vs. Pennants

Flags and pennants can look similar but have key differences:

- Pennants: Form a small symmetrical triangle with converging trendlines, showing brief consolidation before the trend resumes. They typically feature less volatility and are confirmed by a volume spike during the breakout.

- Flags: Create a rectangular or parallel channel shape, representing a brief counter-trend consolidation. Like pennants, they suggest the trend will continue, with the breakout following the current trend.

To distinguish them, note that pennants have converging lines forming a triangle, while flags have parallel lines creating a rectangle.

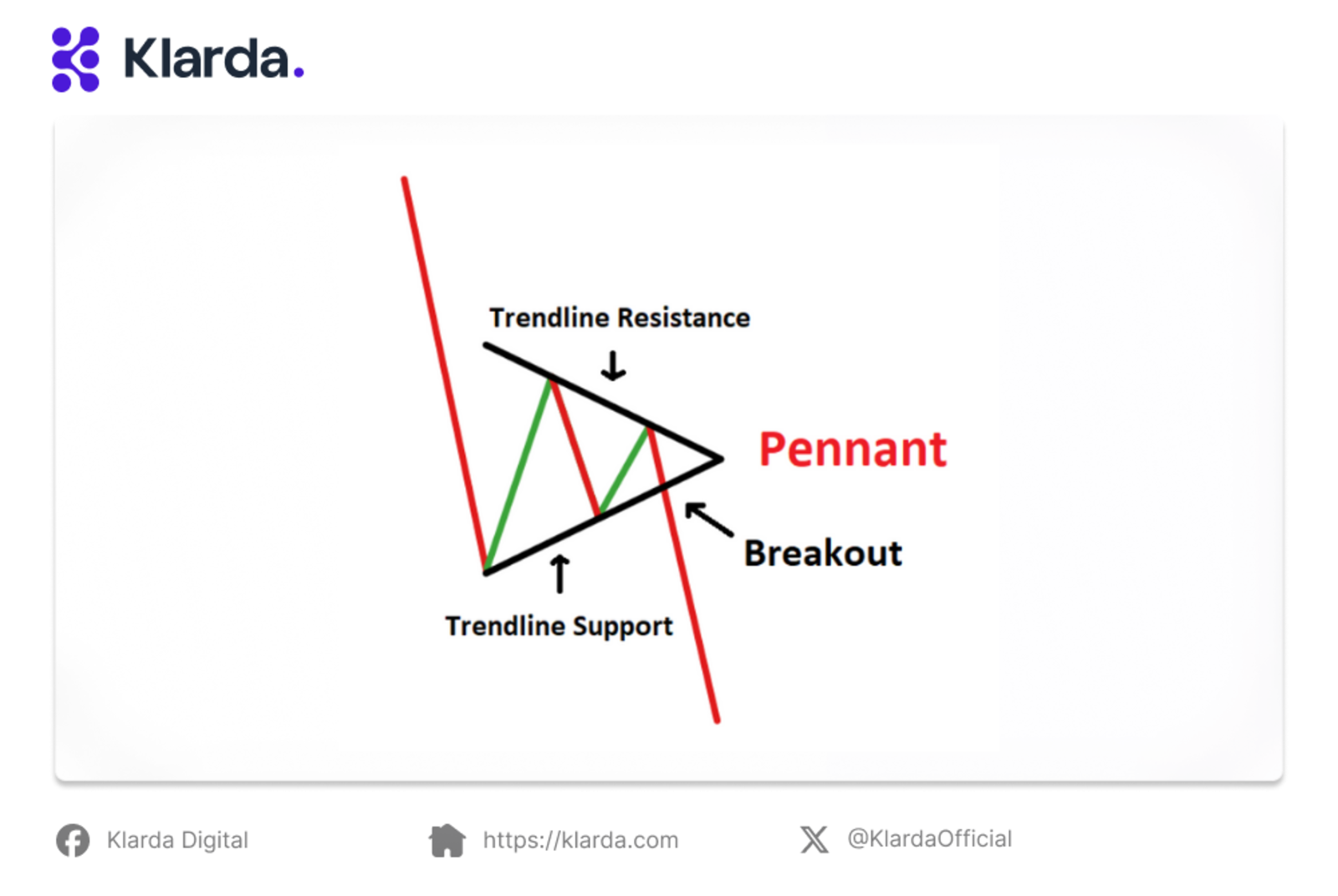

COMPONENTS OF BEARISH PENNANT PATTERN?

The downtrend: this is the initial sharp decline in price, suggesting that the market is likely to continue falling. The downtrend should be clearly established before the pennant forms, indicating alignment with the overall trend. A steep downtrend increases the likelihood of a successful breakout.

Breakdown example

- The Pennant: after the initial downtrend, a period of consolidation occurs, forming the pennant. The highs and lows during this phase create a symmetrical triangle, reflecting ongoing market uncertainty.

- The Breakout: this occurs when the price breaks below the lower boundary of the triangle, signaling a continuation of the downtrend and suggesting further price declines.

HOW TO TRADE THE BEARISH PENNANT PATTERN?

A bearish pennant forms during a steep downtrend, followed by a consolidation phase as sellers either exit or continue the trend. Once selling pressure intensifies, the price breaks below the pennant's lower boundary, signaling a continuation of the downtrend.

To trade this pattern, place a short order at the bottom of the pennant with a stop loss above it to exit if the breakout fails.

Pattern Formation

Unlike other patterns where the next move is roughly equal to the formation height, pennants often indicate larger moves, using the height of the initial drop (the mast) to estimate the breakout's magnitude.

BEARISH PENNANT PATTERN STRATEGIES

Now that we’ve discussed the basics of trading this pattern, let's go over some tips to help you trade it more effectively:

- Trade in a Downtrend: use this pattern only in the context of a downtrend. It's less effective in an uptrend or sideways market.

- Wait for a Confirmed Breakout: don't anticipate the breakout. Wait for the price to clearly break below the pennant before entering a trade.

- Watch for High Volume: strong breakouts often come with high trading volume, indicating strong selling pressure.

- Have an Exit Plan: set a stop-loss to manage risk in case the breakout fails. Always be ready to exit if the price moves against you.

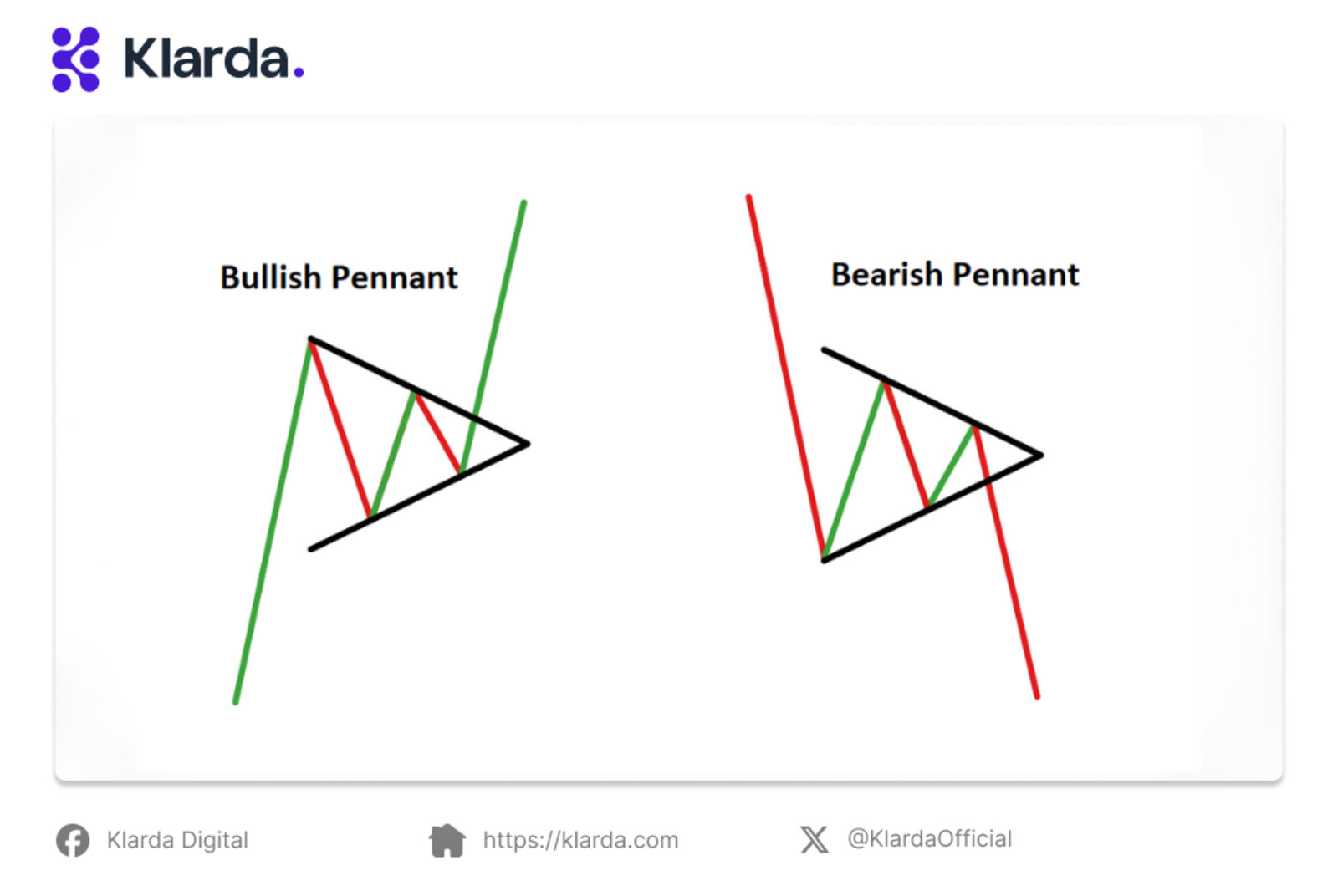

BULLISH PENNANT PATTERN VS. BEARISH PENNANT PATTERN

Bullish pennant vs bearish pennant example

While the bullish pennant pattern indicates a potential continuation of an uptrend, a bearish pennant pattern signals a potential continuation of a downtrend. The key difference lies in the direction of the initial trend and the breakout. In a bearish pennant, the initial trend is downward, and the price breaks below the lower support level of the pennant.

ADVANTAGES AND DISADVANTAGES OF THE BEARISH PENNANT PATTERN

Here are some pros and cons of using a bearish pennant strategy:

Advantages

- Bearish pennants provide traders with a more structured approach to making trading decisions.

- They also help traders steer clear of assets that are in a downtrend phase.

Disadvantages

- There can be misinterpretations or mistakes in identifying bearish pennants, so traders need to remain vigilant.

- When using bearish pennants, it's important for traders to consider other factors that can influence price movements, such as market volatility, fundamental factors, and overall market risk.

FINAL THOUGHTS

The bearish pennant pattern is a powerful tool for traders looking to capitalize on downtrends. By recognizing its key components—the flagpole, the pennant, and the breakout—traders can anticipate potential price declines and make more informed trading decisions.

However, it's essential to remain cautious, as misidentification and market volatility can lead to false signals. Always consider other market factors and use proper risk management techniques to enhance the effectiveness of this trading strategy. So let’s sign up Klarda to solve all of those considerations!

Updated 10 months ago