Gravestone Doji Pattern

Discover how the Gravestone Doji candlestick pattern indicates potential market reversals and how to use it in your trading strategy.

For those new to day trading or swing trading, exploring techniques that utilize technical indicators can be beneficial. Certain candlestick patterns, such as the Gravestone Doji, offer clear signals that can aid in making more informed trading decisions. The Gravestone Doji is a notable pattern that often appears on candlestick charts and can be particularly useful for traders.

Let’s explore more with Klarda now!

KEY TAKEAWAYS

- A gravestone Doji is a pattern observed in technical analysis that signals a potential bearish reversal and subsequent downtrend in price action.

- This pattern, which appears as an inverted T with a long upper shadow, can indicate a good time to take profits on a bullish position or consider entering a bearish trade.

- It contrasts with the dragonfly Doji, which is the reverse of the gravestone Doji.

WHAT IS THE GRAVESTONE DOJI CANDLESTICK PATTERN?

The gravestone Doji is a bearish signal frequently used in technical analysis for trading. This candlestick pattern appears when the open, low, and closing prices are nearly the same, with a long upper shadow extending above. The extended upper shadow indicates that despite a strong bullish start to the session, bears managed to drive the price down by the end. This pattern typically signals a potential shift to a longer-term bearish trend.

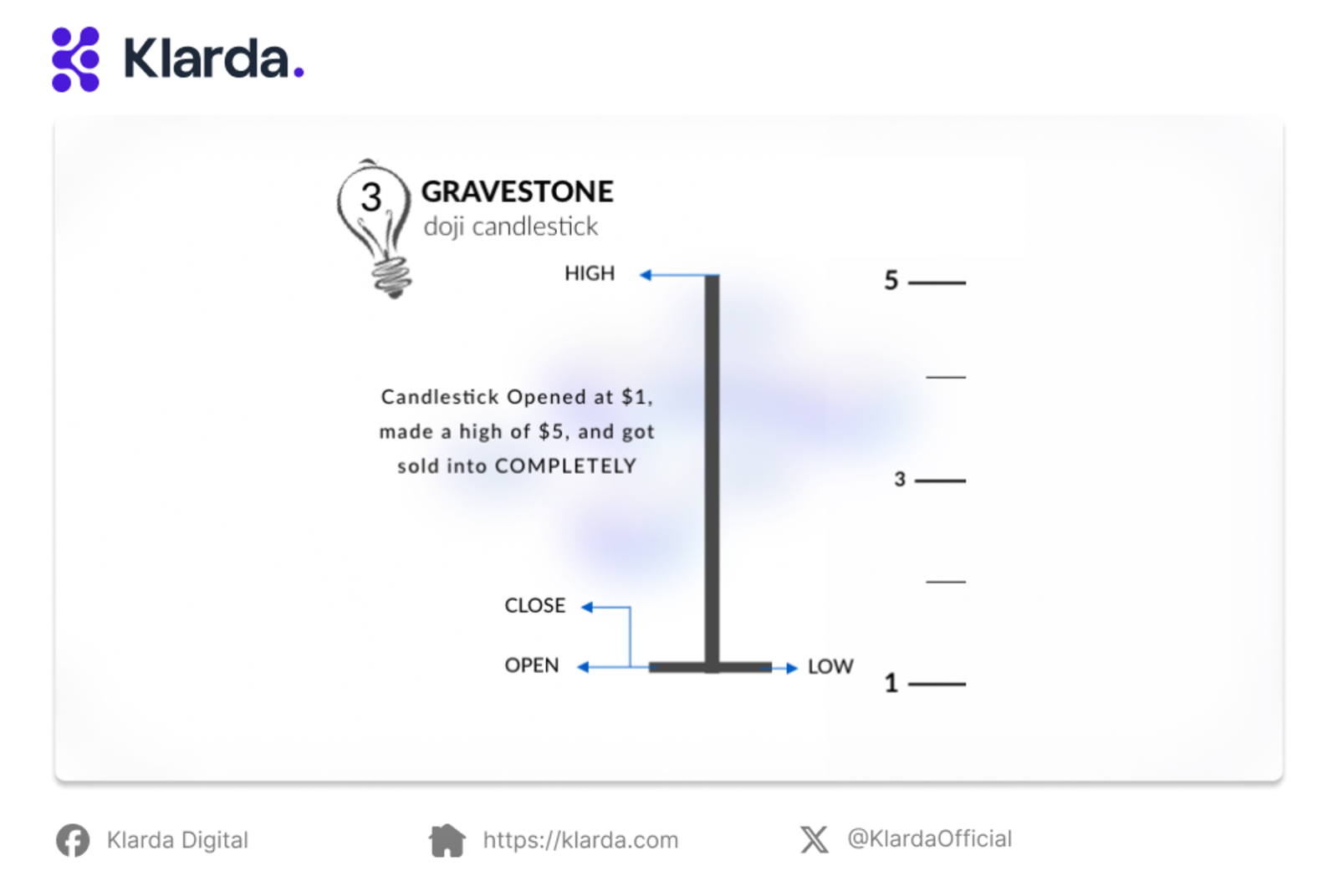

THE GRAVESTONE DOJI CANDLESTICK PATTERN COMPONENTS

The gravestone Doji candlestick pattern components

The Gravestone Doji candlestick pattern is composed of the following elements:

- Open Price: The price at which the asset opens for the trading session.

- Close Price: The price at which the asset closes by the end of the session, which is nearly equal to the open price.

- Low Price: The lowest price reached during the session, which is close to the open and close prices.

- Long Upper Shadow: A significant vertical line extending above the open and close prices, indicating that the price reached higher levels during the session before falling back down.

This pattern forms a distinct "T" shape on the chart and suggests a potential bearish reversal if it appears after a bullish trend.

USING THE GRAVESTONE DOJI CANDLESTICK PATTERN IN TRADING

The gravestone Doji candlestick pattern

Trading with the Gravestone Doji candlestick in the stock market involves several strategic steps, tailored to individual trading styles. Here are five general guidelines for using this pattern effectively:

- Identify the Pattern: Look for the Gravestone Doji on stock charts. This pattern is characterized by the opening and closing prices being close to the candle's low, with a long upper shadow indicating significant selling pressure during the session.

- Confirm with Additional Indicators: Validate the Gravestone Doji with other technical indicators. For example, check for bearish signals such as a bearish divergence in the RSI or a drop below key support levels to confirm the potential for a bearish reversal.

- Plan Your Trade: Once the Gravestone Doji is confirmed, plan your trade strategy. Consider entering a short position, placing a stop loss above the high of the Gravestone Doji to manage risk, and anticipate a price decline based on the pattern.

- Manage Risk: Effective risk management is crucial. Use tools like trailing stop losses or take-profit orders to secure gains and limit potential losses as the trade progresses.

- Monitor and Adjust: Keep an eye on the trade and adjust your position as needed based on evolving price action and market conditions.

A well-defined trading plan, incorporating the Gravestone Doji along with other analysis methods, is key to achieving long-term success in the stock market.

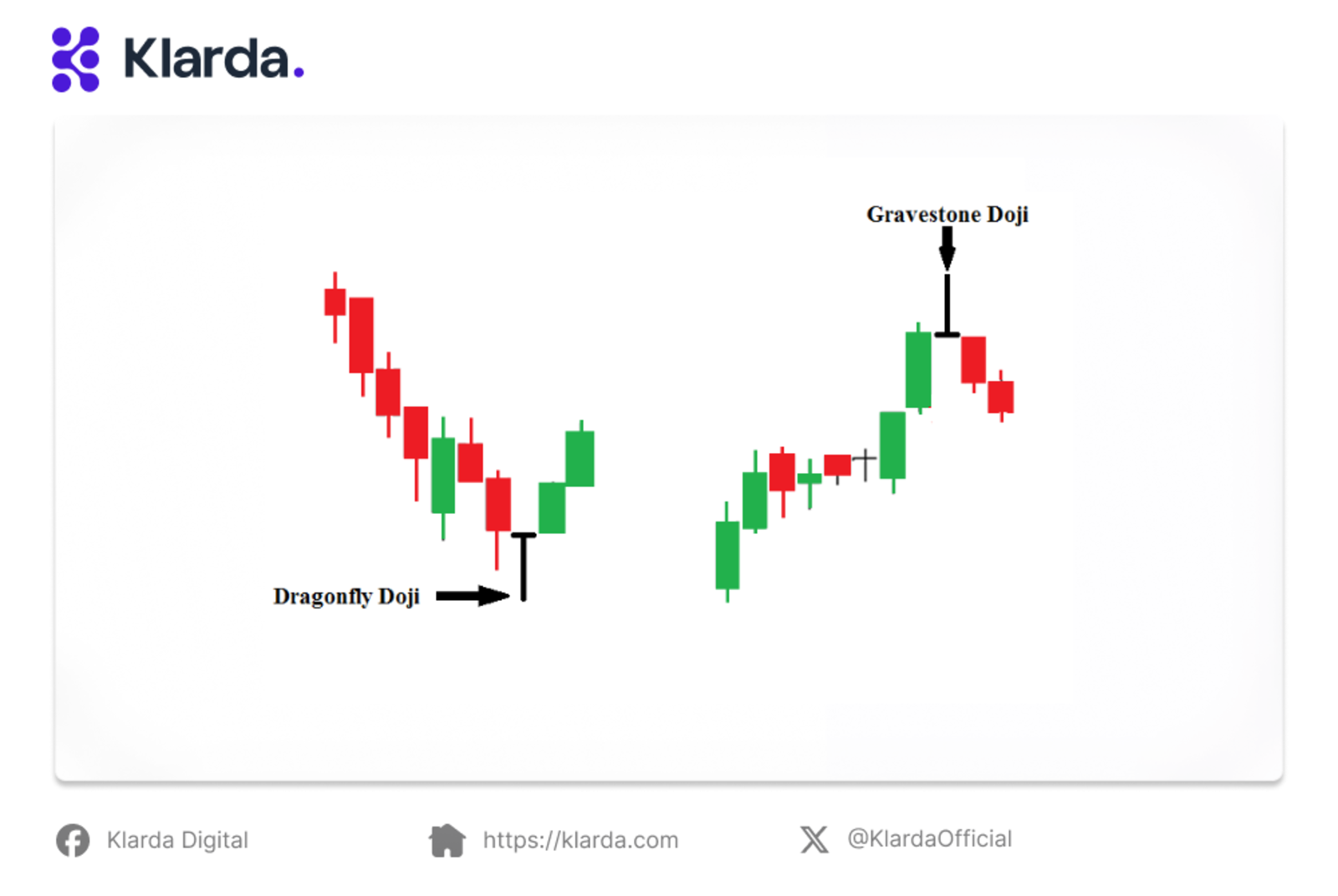

GRAVESTONE DOJI VS. DRAGONFLY DOJI

The Gravestone Doji vs the Dragonfly Doj

The Gravestone Doji's opposite is the bullish Dragonfly Doji. The Dragonfly Doji, which is less common, resembles a "T" shape and forms when the high, open, and close prices are nearly identical. Unlike the Gravestone Doji, the Dragonfly Doji features a long lower shadow, indicating that significant selling pressure occurred during the session.

Although these patterns are often discussed separately, they essentially reflect the same underlying market behavior. One can be interpreted as bullish while the other is bearish, depending on the context. For instance, a Gravestone Doji might precede an uptrend, or a Dragonfly Doji could signal a downtrend.

Both patterns require confirmation through volume and the subsequent candle to validate their significance. It may be more useful to view them as indicators of market uncertainty rather than definitive bearish or bullish signals.

PROS AND CONS OF THE GRAVESTONE DOJI CANDLESTICK PATTERN

Pros:

- Clear Reversal Indicator: Shows potential bearish reversals.

- Simple to Identify: Easy to spot on charts.

- Supports Confirmation: Works well with other indicators and volume.

- Early Warning: Helps in anticipating market downturns.

Cons:

- False Signals: Can sometimes mislead with incorrect predictions.

- Requires Confirmation: Needs additional analysis for reliability.

- Context Dependent: Effectiveness varies with market conditions.

- Limited in Volatile Markets: Less reliable in highly volatile or choppy markets.

CONCLUSION

Many traders rely on technical analysis to leverage market trends, utilizing charts, patterns, and tools based on historical performance, trading volumes, and price history. Among these tools is the Gravestone Doji, an inverted "T" shape that appears within a sequence of candlesticks on a chart. This bearish pattern signals a potential reversal and a forthcoming downtrend in price action.

Understanding how to recognize and use the Gravestone Doji, and combining it with other technical indicators, can help you manage risks and enhance your trading strategy.

For a streamlined trading experience, consider using Klarda app to implement these insights effectively. This is a convenient app that allows you to monitor the market anytime, anywhere, on your phone or web.

The Klarda App has two versions: a web browser version and a mobile app version.

Web browser version: https://klarda.com/

Mobile app version for iOS: https://apps.apple.com/ua/app/klarda-crypto-and-portfolio/id6471593752

Mobile app version for Android: https://play.google.com/store/apps/details?id=com.klarda.app

Updated 10 months ago